Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Tink, in partnership with Visa, Kroo Bank, and Utilita, demonstrated the UK’s first commercial variable recurring payment (cVRP) using Visa A2A, marking a significant advancement in how regular payments are made.

The result? Real-time payments, immediate confirmation, and enhanced transparency for consumers, plus faster reconciliation and improved cash flow for merchants.

Tink's Head of Payments, Ian Morrin, said: “This is a key milestone, but it’s just the start for Visa A2A and the potential impact of this transformative solution. More choice and control is always good news for consumers and businesses.”

For years, UK consumers have mostly relied on Direct Debit to manage recurring bills and subscriptions. It may be familiar to many, but the system is outdated and wasn’t built for the digital age, with little visibility or control over certain payments. Recent Visa research* shows that 60% of UK consumers are open to trying new ways to pay their bills, signalling a strong appetite for change.

What is Visa A2A?

As a quick reminder, Visa A2A is a framework that enhances open banking-based recurring payments. It connects banks and TPPs (like Tink) under a common rulebook, API standard, commercial model, liability framework, and disputes management platform.

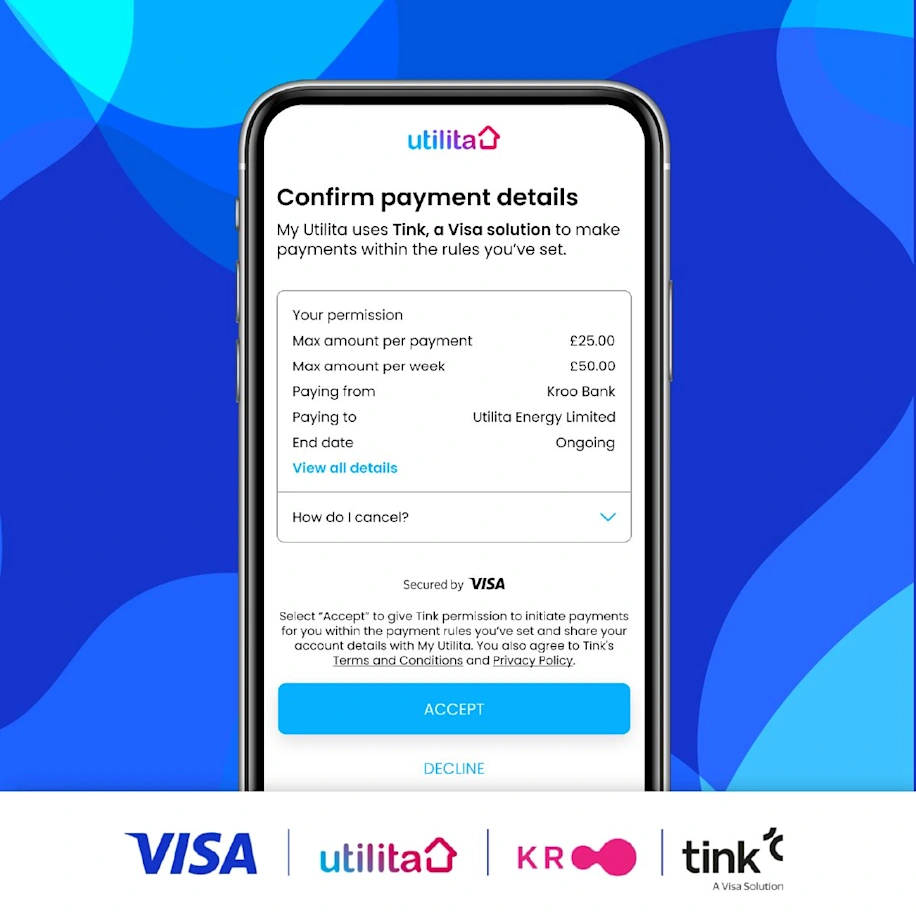

Consumers set and authenticate a mandate with a given merchant that outlines their desired recurring payment terms (e.g. maximum amounts) and securely approve this once for seamless future payments. Once that’s done, they have full visibility and control over the mandate in their banking app.

This means a state-of-the-art Pay by Bank experience, coupled with Visa’s best-in-class consumer protections.

The nuts and bolts of the first Visa A2A transaction

As the payment initiator, Tink sets up the mandate, securely connects to the payer’s bank, checks funds, and triggers the payment flow. In this landmark transaction, Tink enabled a seamless, secure, and near-instant payment, with Kroo Bank authenticating the payer and Visa’s A2A solution providing the framework – including built-in consumer protections – to demonstrate an energy bill payment to Utilita.

The result? Real-time payments, immediate confirmation, and enhanced transparency for consumers, plus faster reconciliation and improved cash flow for merchants.

Why this matters

This first cVRP transaction is more than just a technical achievement. It’s a step towards giving consumers greater control, transparency, and security when managing their money. For businesses, it means faster settlement and a trusted payment experience for their end-users. With these developments, Tink is making open banking work better for people and businesses.

And this is just the beginning. With Visa A2A, Tink is committed to expanding beyond bills and subscriptions to support new use cases, making everyday payments more innovative, secure, and convenient.

“By powering the first cVRP transaction with Visa A2A, Tink is helping to set new standards for speed, security, and transparency in recurring payments,” said Ian Morrin, Tink’s Head of Payments.

“This is a key milestone, but it’s just the start for Visa A2A and the potential impact of this transformative solution. More choice and control is always good news for consumers and businesses.”

---

*Research conducted by Basis, on behalf of Visa, between November – December 2024, among a nationally representative sample of 4,152 consumers (including Gen Z, Millennials, Gen X and Baby Boomers) in the UK aged 18+.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.