Seamless payment experiences, powered by open banking

Accept low-cost bank payments and move money across Europe with customisable, high-performing flows designed to help you capture and retain more revenue.

Get in touchBoost payment acceptance

Accept payments from anyone with a bank account across 18 European countries with one integration. Nobody can match the breadth and depth of our coverage.

Optimise your revenue

Minimise costs and operational overhead by offering direct bank payments with fewer intermediaries, lower rates, and reduced fraud.

Improve conversion

Build a fully embedded flow from onboarding to checkout, letting customers authenticate and pay in a few clicks without leaving your service.

Integrate and scale easily

One API, a fully integrated suite of payment products. Use our libraries and SDKs to test and launch fast, and add new markets at the flick of a switch.

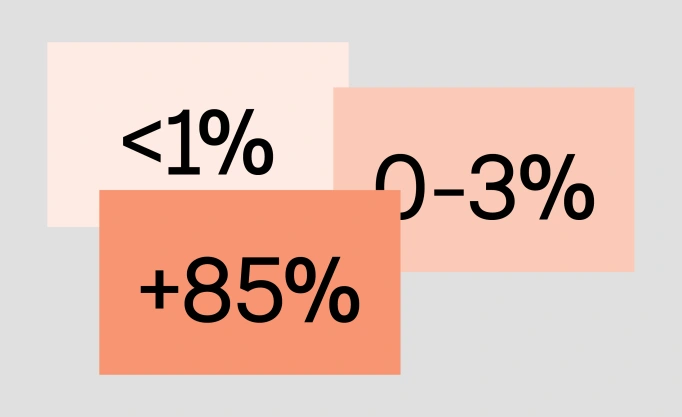

It’s time to rethink payments

The traditional payments landscape is complex and fragmented. Pay by Bank is an account to account payment method, meaning no middlemen or unnecessary fees.

Simple, fast, and low-cost

Pay by Bank lets you initiate direct payments within any service and own your customer journey end-to-end. No fraud, no chargebacks, and none of the usual fees.

Ever-improving conversion

Open banking journeys are improving rapidly across Europe. With zero data entry and fewer redirects, it’s already the most frictionless way to pay online in some countries.

It’s time to rethink payments

The traditional payments landscape is complex and fragmented. Pay by Bank is an account to account payment method, meaning no middlemen or unnecessary fees.

Simple, fast, and low-cost

Pay by Bank lets you initiate direct payments within any service and own your customer journey end-to-end. No fraud, no chargebacks, and none of the usual fees.

Ever-improving conversion

Open banking journeys are improving rapidly across Europe. With zero data entry and fewer redirects, it’s already the most frictionless way to pay online in some countries.

Trusted to be the best

Industry-leading volumes

6.2 million payments initiated every month – and counting.

Best-in-class conversion

80%+ average end-to-end success rate.

Connectivity that performs

1.1 billion account refreshes per month, with 99.9% uptime.

Designed to work for you

From PSPs and platforms to ecommerce businesses, we support almost any payments use case with a flexible stack of tools to accept payments, onboard customers, and simplify risk and operations.

Payment providers

Create your own Pay by Bank payments solutions to enable better user experiences for your customers, from onboarding to checkout and payouts.

Platforms and marketplaces

Embed open banking flows into your platform to simplify account verification and onboarding, and facilitate payments across Europe through one simple integration.

Ecommerce businesses

Boost conversion and reduce costs by offering a fully customisable Pay by Bank payment method, letting customers pay in a few taps without leaving your service.

The most cost-effective way to accept payments online

Offer secure, low-cost payments with all the features you need, across any channel, powered by bank connections that perform at scale.

Reduce costs

Pay by Bank simplifies transactions by directly transferring funds between bank accounts, bypassing traditional intermediaries and significantly reducing payment fees.

Maximise acceptance

Accept payments from anyone with a bank account, anywhere in Europe. We’ve built direct connections to over 90% of banks in key markets, and won’t stop until our coverage is universal.

Minimise fraud

With Strong customer authentication (SCA) on every flow, Pay by Bank ensures the highest possible security standards with minimal fraud exposure and no chargebacks.

Increase sales with a better payment experience

Create a fully embedded, high-performing payments experience that lets users pay without leaving your service. No lengthy forms, no manual data entry, no clunky redirects.

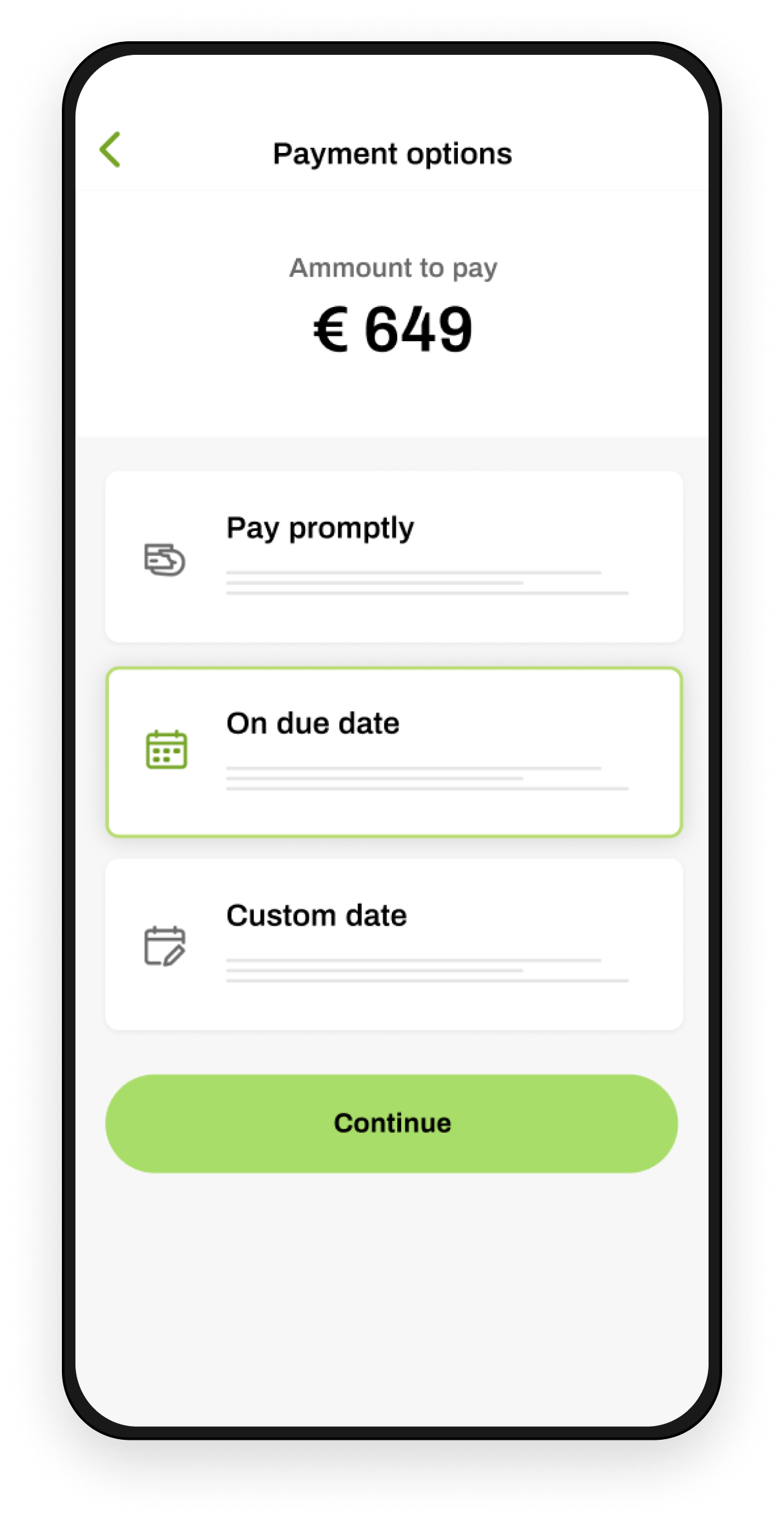

Keep customers engaged

Pay by Bank lets users pay in as little as a couple clicks, using their fingerprint or Face ID, minimising drop-off from excessive redirects or having to enter card details.

Customise the experience

We don’t believe in a one-size-fits-all approach and we’re not a consumer-branded scheme. You can customise the entire flow to fit your brand and preferred user journey.

Increase conversion

With over 1bn monthly API calls, we continually monitor and test our flows with thousands of banks to help increase conversion and uptime at every level of the payments stack.

How Kivra is using Payments

Kivra is one of Europe’s leading consumer apps for bills and invoices and uses Tink to process 4 million payments per month, all in-app and powered by open banking.

How Kivra is using Payments

Kivra is one of Europe’s leading consumer apps for bills and invoices and uses Tink to process 4 million payments per month, all in-app and powered by open banking.

How Kivra is using Payments

Kivra is one of Europe’s leading consumer apps for bills and invoices and uses Tink to process 4 million payments per month, all in-app and powered by open banking.

Solutions across the payment journey

Onboarding

Merchant account verification

Instantly verify account ownership

Direct debit setup

Autofill account details and check balances

Payout setup

Automatically verify and update details

Payments

One-time payments

Account-to-account payment initiation

Payment collections

Notifications, settlement and reconciliation

Refunds, payouts, and fee splits

Full or partial refunds and complex flows

Risk and operations

Merchant cash advance

Adapt repayments to cash flow in real time

Income and identity verification

Programatically check income and identity

Balance checks

Perform instant, real time balance checks

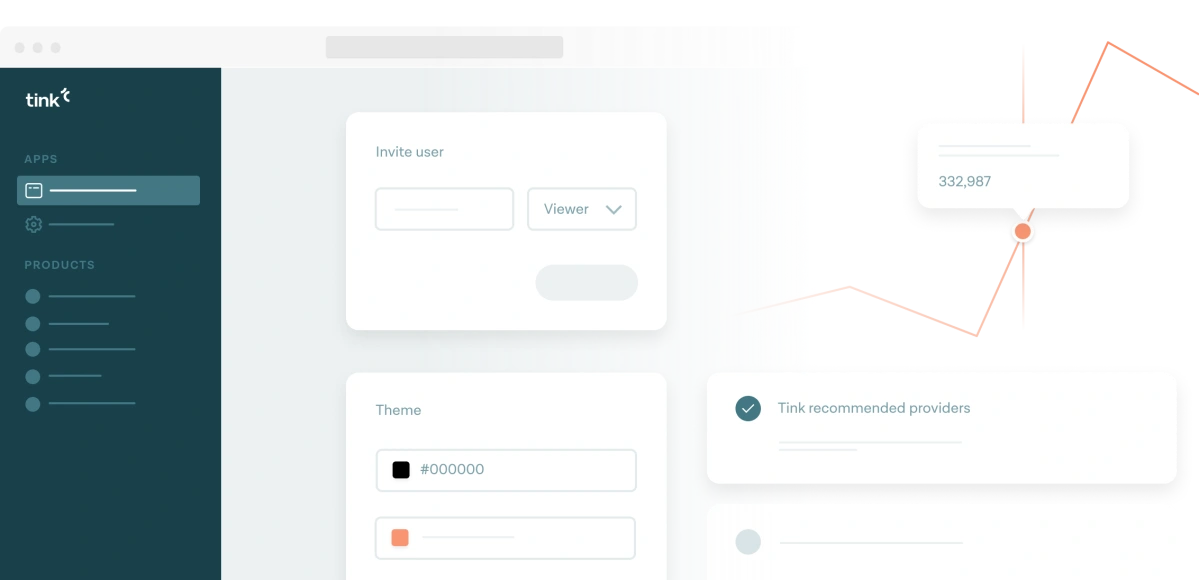

One API, a fully integrated suite of payments products

Easily integrate with the Tink platform and expand across Europe at the click of a button.

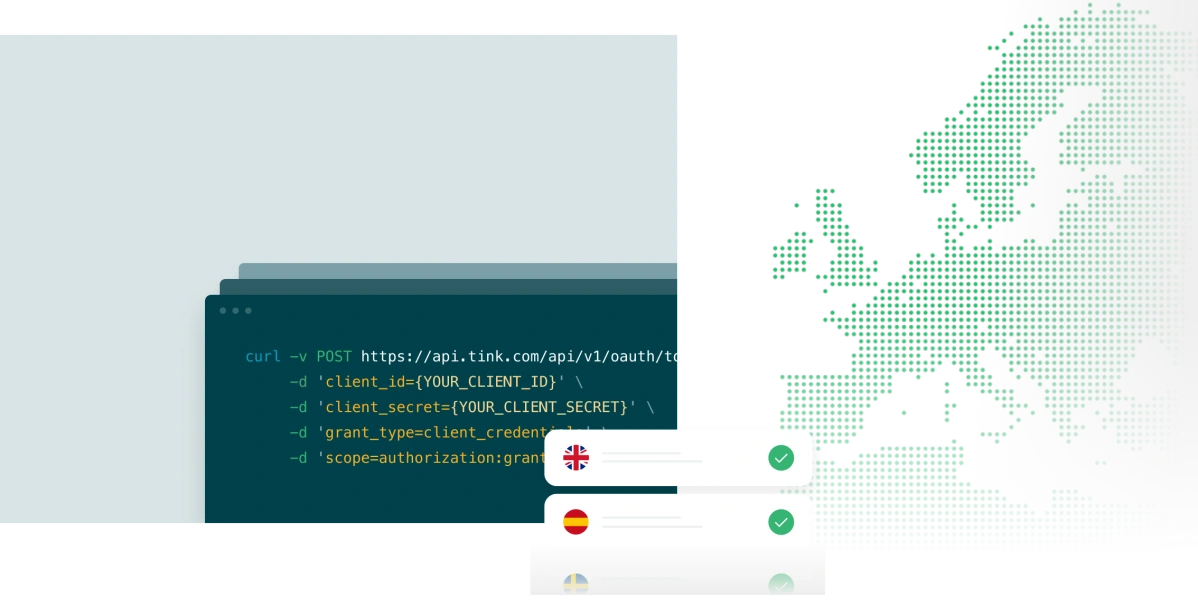

Integrate with a single line of code

Use our suite of tools, SDKs, and resources to integrate fast, with one integration connecting you to 6000+ banks across 18 countries in Europe.

Add new markets with no extra work

Authenticate millions of end-users across Europe through a link, with all localisation and compliance taken care of.

Test, launch, and iterate faster

Configure, customise, and manage your flows all within the Tink Console, with real-time usage and performance reports.

Grow across Europe with a platform built for scale

18

countries across Europe

6,000+

Connections to all major banks across Europe

1bn+

monthly API calls