41% of financial executives believe the digital shift caused by Covid is permanent

London, 8 June 2021: A new report published today from open banking platform Tink suggests that Covid-19 has irreversibly increased the shift to digital financial services.

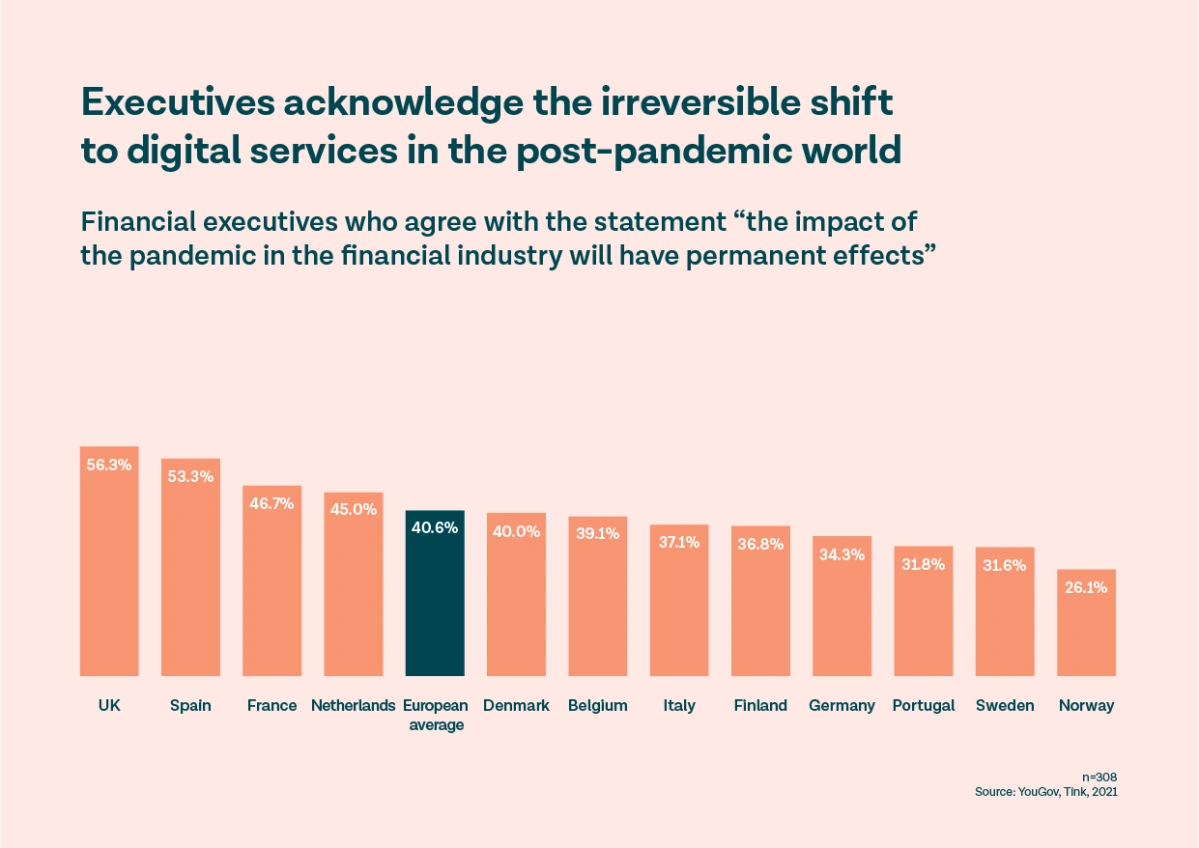

As a result of the pandemic, financial institutions have been forced to adapt to more digital ways of serving their customers, while people across all age groups have had to become familiar with using more digital services. This has led to the digitalisation of financial services being fast-tracked – and 41% of European financial executives believe the effects of the Covid-19 pandemic on the financial services industry will be permanent.

Open banking gets a boost

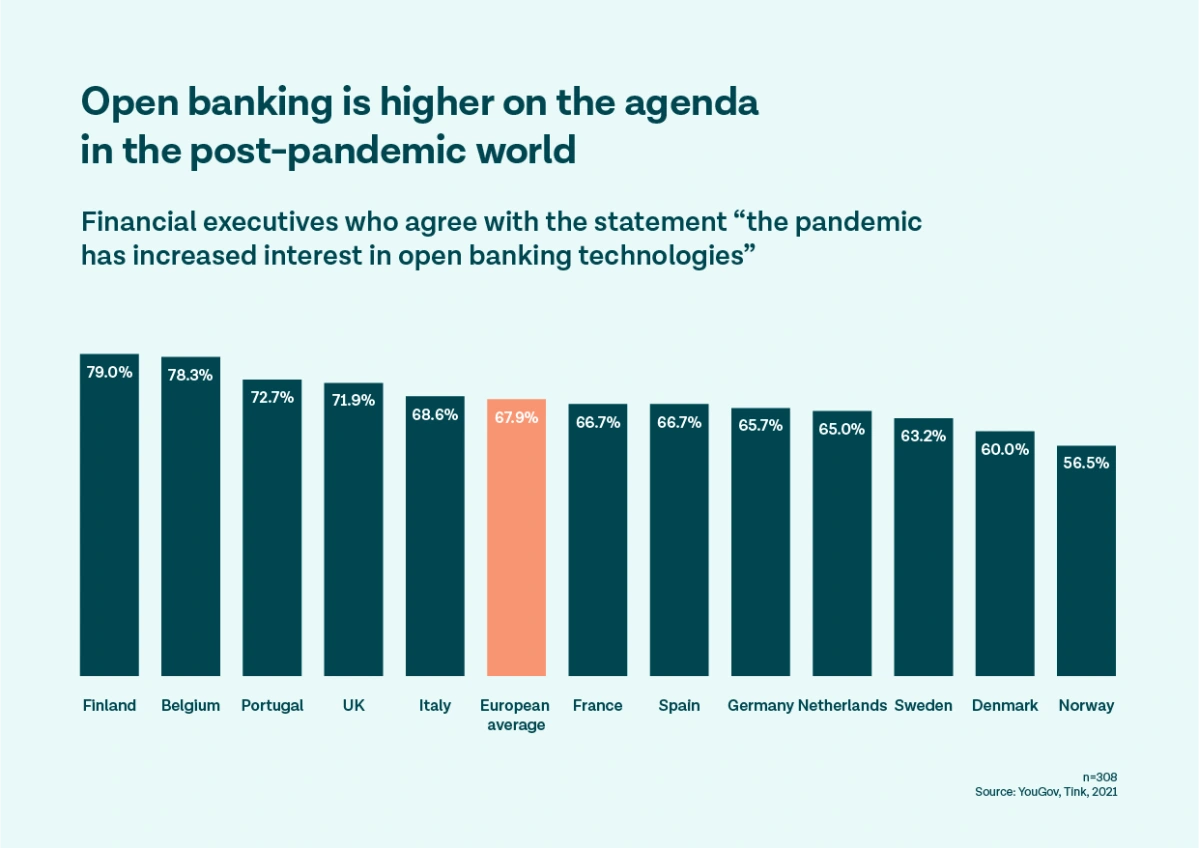

Even in light of the digital transformation efforts that have been set in motion over the past few years, 65% of financial executives across Europe still believe that banks need to increase their speed of innovation. This digitalisation shift has resulted in an increased appetite for financial institutions to leverage technology, and find solutions to new challenges as a result of Covid-19. In fact, more than two-thirds (68%) of European financial executives say their interest in open banking has increased during the pandemic.

The report also shows that the pandemic has focused European financial institutions on three key business priorities. Three-quarters (74%) of executives see an increased need to enhance their digital services – to streamline onboarding and manage more customers digitally. While 70% are also focused on the customer experience – to differentiate themselves from competitors and boost customer engagement in an increasingly digital world. For 68% of financial executives, there is an increased focus on restoring profitability, through automating and streamlining business processes.

Lasting long-term impact or short term blip?

However, despite the big shifts the financial services industry has witnessed during the pandemic, 59% of financial executives still see the transition to digital as a short-term blip, and expect things to return to normal. Similarly, only two-thirds (67%) of respondents think that Covid-19 has increased business risk, despite clear signs of looming economic danger on the horizon – with households under increasing financial distress, non-performing loans set to rise and businesses at risk of bankruptcy when governmental support runs out. This suggests that some European financial institutions are at risk of sleepwalking into a future of unforeseen challenges that may have a severe impact on their customers, unless they recognise the significant and lasting impact that Covid-19 has had on the financial industry.

Daniel Kjellén, co-founder and CEO, Tink, said: “The pandemic hasforced many executives to remedy the lack of personal interaction with customers by focusing on delivering digital services. But this has also provided a way of creating more value for the customer, while increasing insights to identify or even predict potential risks and new demands. Financial institutions have seen that open banking technology presents opportunities to increase the speed of innovation, introduce new commercial streams and revenue opportunities, while enabling operational efficiencies that will benefit their business long term.

“But there are also many executives who are expecting things to go back to normal, who will need a plan on how to respond and where to focus their digitalisation efforts as the transformation of financial services continues to pick up pace. We have set out to help empower the pioneers of financial services – the banks that are looking at technology not as a cost, but as an opportunity to improve many of the things they do today. How they operate internally, how they deliver their products, and how they will serve their customers in a post-pandemic world.”

— END —

To download the report, please go to: http://tink.com/resources/reports/open-banking-post-pandemic

Contact details:

Mattias Lindquist, PR & Communications Director, press@tink.com, +46 8 509 08 999

About the research

For the third year in a row, Tink has enlisted the help of independent market research organisation YouGov to conduct a wide-ranging survey on the attitudes and opinions towards open banking in Europe.

All interviews were conducted by YouGov between February 25 and March 27, 2021, and included 308 prominent financial services executives spread across 12 countries. This first report for 2021 looks into the impact of the pandemic, the potential challenges that lie ahead in the post-pandemic world, and some of the solutions enabled by open banking.

About Tink

Tink is Europe’s leading open banking platform that enables banks, fintechs and startups to develop data-driven financial services. Through one API, Tink allows customers to access aggregated financial data, initiate payments, enrich transactions, verify account ownership and build personal finance management tools. Tink connects to more than 3,400 banks that reach over 250 million bank customers across Europe. Founded in 2012 in Stockholm, Tink’s 400 employees serve more than 300 banks and fintechs in 18 European markets, out of offices in 13 countries. We power the new world of finance. For more information, visit tink.com.