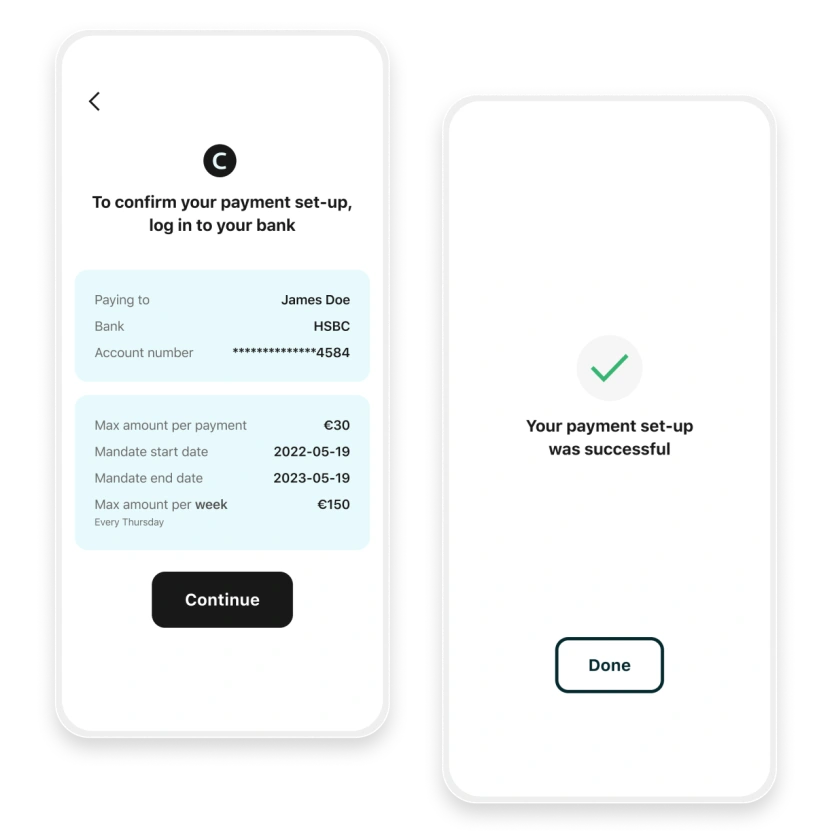

Select product

Choose payment type

Select bank

Set up payment

Authenticate

Success

Get to know VRPs

VRPs are the new, digital-first way to enable frictionless recurring payments – all powered by open banking.

Real-time payments

Instant or near-instant payments

Real-time payment confirmation

Synchronous status updates

Flexible mandates

Custom collection cycles

Smart retries

Instant notification of funds

Account to account

Secure bank authentication

Open banking payment technology

Recurring payment dashboards

How can VRPs help you?

Billing and invoicing

Upgrade the customer experience and minimise collection failures with efficient, flexible billing cycles and instant settlement.

Learn moreOne-click payments and top-ups

After authenticating just once, your customers can make one-click payments that settle instantly on an ongoing, ad-hoc basis.

Learn moreSubscriptions

Minimise collection failures by pre-verifying account balances and receiving instant status updates.

Credit and lending

Give customers a better way to repay loans, credit cards, and overdrafts by automatically collecting funds from an account with a positive balance.

Why your customers will love VRPs

More control

Set maximum payment amounts, collection dates and a time limit on the mandate consent.

Transparency

See all recurring payment mandates in one place and get live notifications when payments are collected.

Simpler setup

No need to enter details manually – authenticate recurring payments once with Face ID or a fingerprint and get an instant confirmation.

How businesses can use VRPs

VRPs work similarly to direct debits, except payments are authenticated right away with the customer’s bank and run on open banking rails – meaning it’s faster, more cost-effective, and secure.

Ad-hoc payments such as automated top-ups

Fixed recurring payments for subscriptions or rental payments

Variable recurring payments for loan or BNPL repayments and utility bills

How businesses can use VRPs

VRPs work similarly to direct debits, except payments are authenticated right away with the customer’s bank and run on open banking rails – meaning it’s faster, more cost-effective, and secure.

Ad-hoc payments such as automated top-ups

Fixed recurring payments for subscriptions or rental payments

Variable recurring payments for loan or BNPL repayments and utility bills

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.