Debunking the 5 biggest myths about Pay by Bank

Almost as soon as it arrived, open banking was simultaneously heralded as a revolution in payments and yet not quite ready for the task. But what's actually true and what's false about its effect on the payments landscape? Let's cut through the noise and bust some of the most persistent myths about Pay by Bank.

Since the introduction of open banking it has been hailed as both enabler and disruptor of the payments industry.

In this article, we debunk some of the persisting myths around the disruptiveness of open banking payments like Pay by Bank.

Instead, we show that the market is more than ready for Pay by Bank and that they will join rather than eliminate other incumbent payment methods on the playing field.

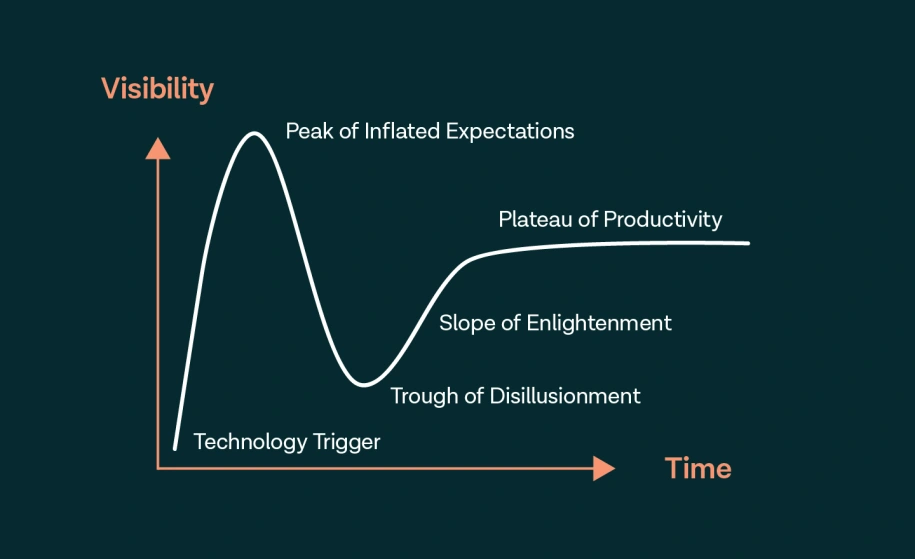

When new technologies emerge, it’s all too tempting to be taken in by their early promise. Their success becomes a question of when, not if, and it’s hard to separate the bold claims from what’s actually viable. Then, as the early hype fades, an apparent lack of progress – plus low knowledge and awareness – can create doubts and negative narratives. Market research firm Gartner even modelled this process, introducing the Hype Cycle back in 1995.

It’s interesting to imagine where Pay by Bank sits on this curve today – you don’t have to look too far to see evidence of the cycle at work. Since the PSD2 deadline in 2019, opinion has veered from the naively optimistic to the overly pessimistic and back again.

But when you look past the hype you see there are many persistent myths about Pay by Bank – myths in need of busting. Here are five of the most important ones.

#1 Pay by Bank could cause incumbents to lose their share of wallet

Some critics say that open banking is disintermediating the incumbents, dislodging banks and other traditional players from the all-important customer relationship. That the addition of Pay by Bank would cause other payment methods to completely lose their share of wallet is a continuation of that argument. In fact, what we’re seeing is that payments – or the financial industry as a whole – isn’t a zero-sum game.

The digital transformation of the payments industry has accelerated since the pandemic, with cash usage declining by 4-5% in 2020 according to McKinsey. While this shift has benefited all digital payment methods, cards and digital wallets have been the biggest winners. According to an FIS report, use of digital wallets grew by a record 7% in 2020. In most cases the underlying payment instrument is a credit or debit card.

There’s little evidence that the rise of open banking is eating into incumbent methods' payments volume. Rather, the entire pie is growing and will continue to grow as digital transformation accelerates. After all, cash is still king across most of Europe, accounting for 73% of in-person transactions in 2019.

Open banking offers many key benefits such as low transaction fees and low fraud rates. Because of this, Pay by Bank is becoming an important addition to a merchant’s payment mix. And there’s undoubtedly momentum: bank-to-bank payments are one of the fastest-growing payment methods in Europe.

But the myth that for Pay by Bank to ‘win’ someone or something has to ‘lose’ is largely just that, a myth.

#2 Open banking hasn’t found its payments use case yet

Sceptics, on the other hand, still tend to see Pay by Bank as a solution waiting for a problem. Payments work just fine today, so the argument goes, and open banking is yet to prove it can do better.

This is a fairly easy myth to bust, because we have so much evidence to the contrary. Let’s take two key use cases as examples: invoices and account top-ups.

In Sweden, close to 50% of the population are now able to pay their monthly invoices via open banking through Tink customer Kivra, and many do just that. Another Tink customer, Wealthify (backed by Aviva), now enables tens of thousands of UK investors to top up their accounts using open banking with an end-to-end success rate above 80%. There are many other such examples.

Pay by Bank is booming in these two use cases – invoices and account top-ups – because there’s a clear product-market fit. It’s fast, cheap, secure, and provides a great user experience. And merchants are recognising this. It may be some time before open banking starts to dominate in ecommerce payments but, based on how it has adapted and thrived up to now, we wouldn’t bet against it.

#3 Adoption has been sluggish up to now

Sceptics also like to point out that consumer adoption of Pay by Bank remains relatively low. There is some truth to this. In 2021, according to OBIE data, 5 million people are estimated to have used open banking in the UK (around 10.6% of the banked population) with around 1 million new users added every 6 months. While impressive, an estimated 98% of the UK’s banked population hold a debit card.

Maybe it’s time for a bit of a reality check. ‘Four years ago,’ as OBIE chair Charlotte Crosswell puts it, ‘open banking was a concept in name only’. Open banking is a new technology and even newer as a payment method. Consumer awareness remains low. This doesn’t matter, though. What matters is that when consumers are presented with an open banking payment flow, they intuitively understand how it works and find it easy to use. And this is exactly what’s happening: in the UK and Nordic countries, Tink customers typically find that Pay by Bank reaches a 50% share-of-checkout within the first six months.

So, where consumers can pay with open banking, they’re readily adopting it. Based on internal data and data from other providers, we at Tink estimate that around 50 million Europeans have now used open banking services. And as merchant demand increases and the user experience improves, the number of consumers exposed to open banking will only increase. According to one industry forecast, the proportion of consumers in western Europe using Pay by Bank will grow from 3.6% in 2020 to 15.7% by 2024.

#4 Consumers need to be educated about open banking

This myth ties in to concerns about low consumer adoption. It argues that consumers won’t trust and, ultimately, won’t adopt a new payment method without being educated or incentivised to do so.

This argument simply doesn’t stack up with reality. Consumers aren’t loyal to a payment method. They seek convenience and security and will choose whichever payment method offers both aspects most clearly. Crucially, this is where open banking excels.

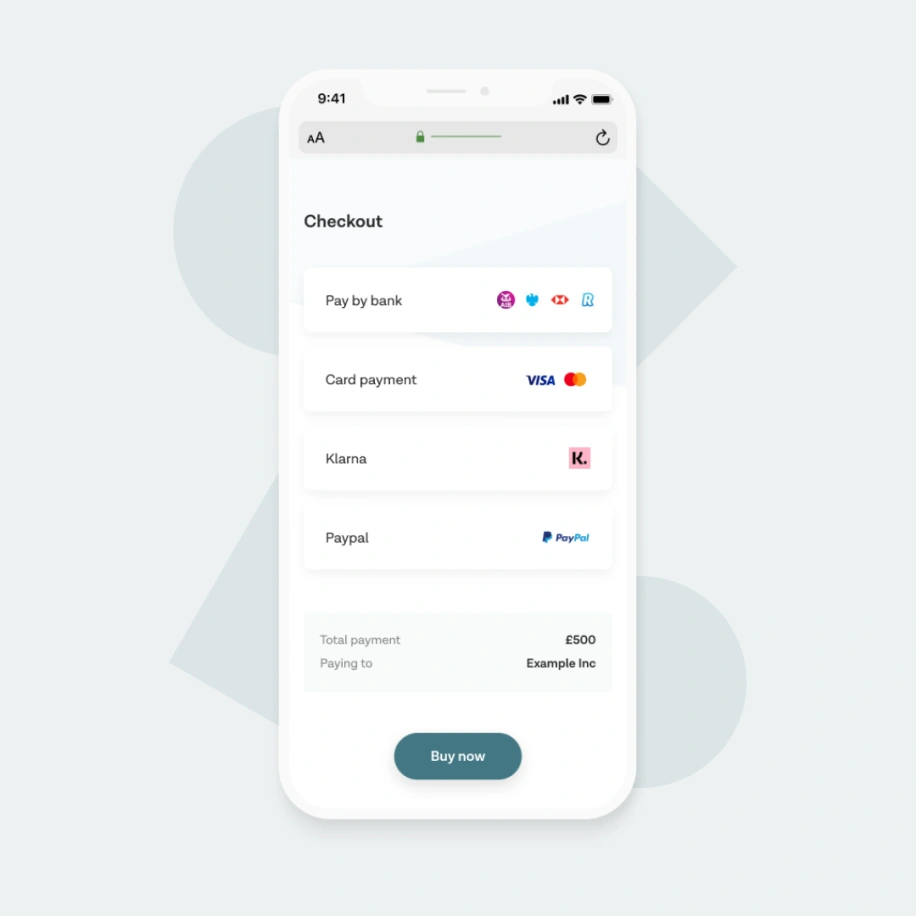

Pay by Bank is designed to be digital- and mobile-first and uses the latest authentication methods, making it a safe payment option. There’s no need to manually enter bank details, the end-to-end user experience is seamless, and fraud is virtually eliminated.

What’s more, open banking flows are customised per bank – and consumers trust their bank more than almost any other institution. This isn’t to say that users don’t need any guidance whatsoever. Whenever you introduce a new technology or payment method, it makes sense to prepare your users (we cover this in our UX guide). But consumers will always gravitate towards the payment method that gets the job done fastest and with the least friction. This increasingly means open banking.

#5 Pay by Bank isn’t ready to go mainstream

This is, in effect, the culmination of several bearish arguments about Pay by Bank. Let’s debunk it once and for all.

In terms of Gartner’s Hype Cycle, open banking payments like Pay by Bank seemingly hit the ‘peak of inflated expectations’ almost overnight when PSD2 was introduced. And the ‘trough of disillusionment’ followed soon after: poor API quality resulted in less-than-reliable bank connections and a below-par UX. Users could be redirected multiple times and asked to go through two or more SCA steps, with success rates suffering as a result. Unsurprisingly, a lot of open banking’s early momentum was driven by account information services (AIS), not payments.

Starting in 2019, regulatory initiatives and increased bank participation began to take effect. Open banking flows have been improving rapidly ever since, thanks to features like app-to-app redirect and biometric authentication, with payment volumes rising exponentially. In February 2020 there were an estimated 100,000 payments across the entire industry. As of June 2022, Tink alone processes up to €60 million EUR in payments per day – a figure that’s steadily rising.

There is still regional variance in API quality and user experience. But in more mature markets like the UK and the Nordics we can already see a flywheel effect taking place where increasing volumes lead to a better UX (as banks are incentivised to improve their flows), which in turn stimulates merchant demand and higher volumes. Today, over 50% of Swedes have been exposed to Pay by Bank through Tink customer Kivra. In the UK, 1 million Brits become active users of open banking every months. If that’s not ‘going mainstream’ then what is?

The rise of Pay by Bank

We’re now seeing open banking add value to a wide range of payments use cases and, in the coming years, we expect to see them gain truly mass adoption through sectors like subscriptions and ecommerce. Yes, some countries are ahead of others, and making the most of the potential still requires know-how and expertise. That’s why Tink partners closely with customers to optimise for local market nuances and the best possible user journey.

Each phase of the Hype Cycle supposedly lasts two years, and only with time do we understand a new technology’s true value – known as entering the ‘plateau of productivity’. It’s easy to forget that Pay by Bank has only existed for a few years. When you take a step back you realise that, relative to other emerging technologies, the rate of progress has been unusually fast. And it will only accelerate as key partnerships go live: Revolut is expanding Pay by Bank to several European countries in 2022 together with Tink.

Open banking’s early adoption phase may have lasted longer in payments than initially hoped for, but the narrative that it’s not yet ready to go mainstream is kind of moot. It already is.

Want to know more about what Pay by Bank could mean for you and your business? Get in touch.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.