Investment platforms: what to look for in an open banking partner

Few businesses benefit more from open banking than trading, brokerage, and wealth management platforms. This post covers the key capabilities you should prioritise when choosing a provider: pay-ins, withdrawals, onboarding, and coverage.

Open banking payments are playing a clear and vital role for wealth management and investment platforms.

To truly excel with open banking payments, you need to partner with a provider who understands your specific needs.

‘Coverage’ numbers can often be misleading, giving you a false sense of scalability and reach. Partner with those who are proven to handle large volumes.

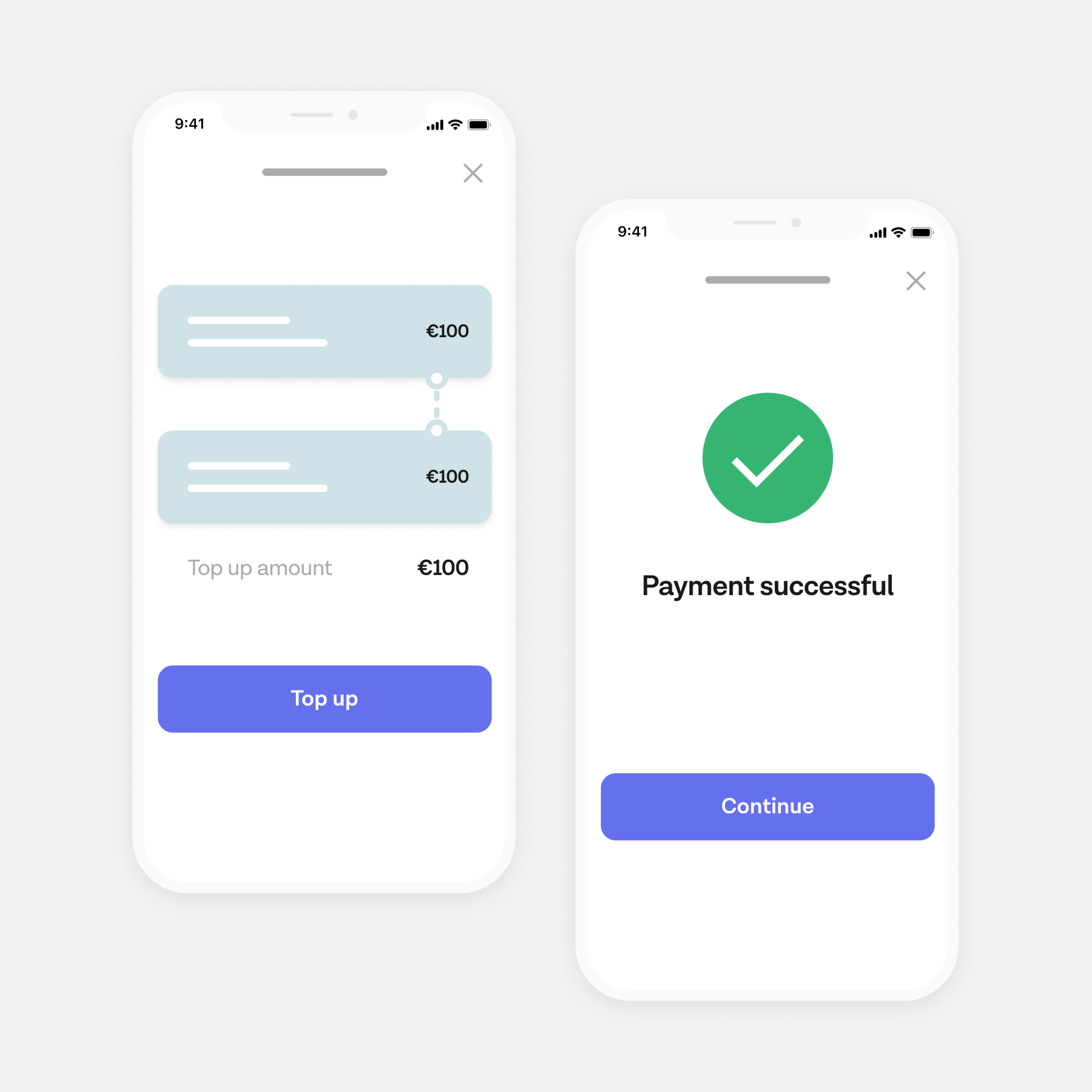

Every investment or wealth management platform needs to onboard users, bring money in, and pay money out. Fortunately, the account funding or top-up use case is one where open banking payments are already clearly established. When we surveyed 380 financial executives across Europe, 1 in 3 saw account top-ups as the top use case for open banking. Companies like Lydia, Wealthify, and Solidi have already made it a core part of their flows.

By partnering with Tink, Wealthify lets users top up their account instantly as part of the onboarding flow

You can boil down all the benefits of open banking for this sector into one word, speed: real-time account verification, instant deposits, and immediate withdrawals. But knowing the potential benefits isn’t enough. You need a partner that can deliver them. Below are the most sought-after features and the key questions to ask any potential provider.

Fast, simple deposits

In trading and wealth management, speed is everything – the process from signing up to trading or investing needs to be frictionless to minimise drop-off. Forcing users to manually enter their details, leave your service to make a bank transfer, and wait for the funds to arrive in their account will drive some to look for quicker alternatives.

Traditional ways of topping up an account, such as a bank transfer or direct debit, can be a time-consuming experience. Card payments, too, often require manual user input and are increasingly subject to 3-D Secure verification steps, with clunky authentication flows bolted onto the payments journey – not to mention the high fees businesses can incur.

Real-time settlement

With open banking payments, users can securely top up their account in a few clicks as part of an onboarding flow, authenticating directly with their bank with a fingerprint or Face ID before being automatically redirected to your service. But this matters little if users have to wait for the funds to arrive – and not all open banking providers offer instant deposits. Only with real-time payment confirmation and settlement can you give users immediate access to your service and leverage the full benefits of open banking.

UX optimisation

There are a number of potential ways to cut open banking flows down even further. With Tink you can combine real-time payments and account verification in one onboarding flow, for example. Some providers may also enable you to optimise the user experience by removing steps, such as pre-selecting the user’s bank and pre-filling their details.

To really gain a competitive edge, you should also ask potential providers whether they support a single Strong Customer Authentication (SCA) step Europe-wide. Open banking payments typically require two SCA steps in some markets like Germany, Italy, and Sweden.. After implementing our new 1-SCA feature, Tink customers saw their average payments journey time reduced by 20-40 seconds.

In the future, Variable Recurring Payments could offer a frictionless, low-cost option for recurring top-ups, enabling users to schedule top-ups at variable amounts and intervals on an ongoing basis without the need to authenticate and confirm every payment.

Questions to ask your provider:

Do you offer real-time settlement?

In which markets do you support instant payments?

What’s the average duration of your account top-up flows?

Can you guarantee a single SCA step across Europe?

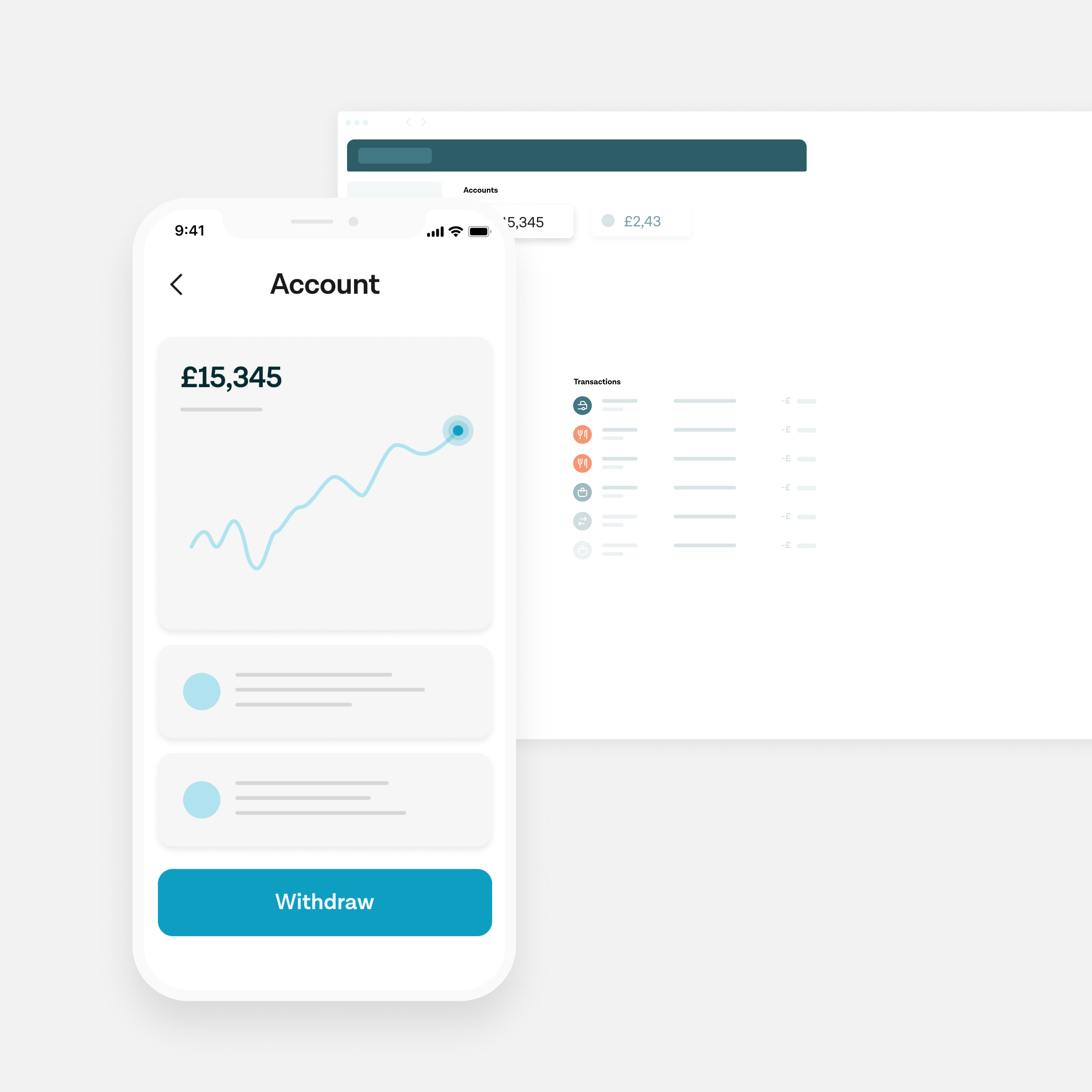

Instant withdrawals

Fast payouts are a crucial differentiator for trading and wealth management platforms, providing instant gratification to users and boosting loyalty. Open banking enables companies to offer this functionality, settling much faster than traditional bank transfers – which can take up to 5 days – and at a significantly reduced cost versus paying out to cards or e-wallets.

Crucially, not all open banking providers offer payouts, and those that do may see settlement times vary according to the availability of instant payment rails in a given market. Another key aspect is to what extent the functionality is automated and programmable, letting you cut out manual processes and simplify reconciliation

Questions to ask your provider:

Do you offer real-time withdrawals?

What are the settlement times in markets X, Y, and Z?

Do you offer full or partial withdrawals?

How easy is it to automate?

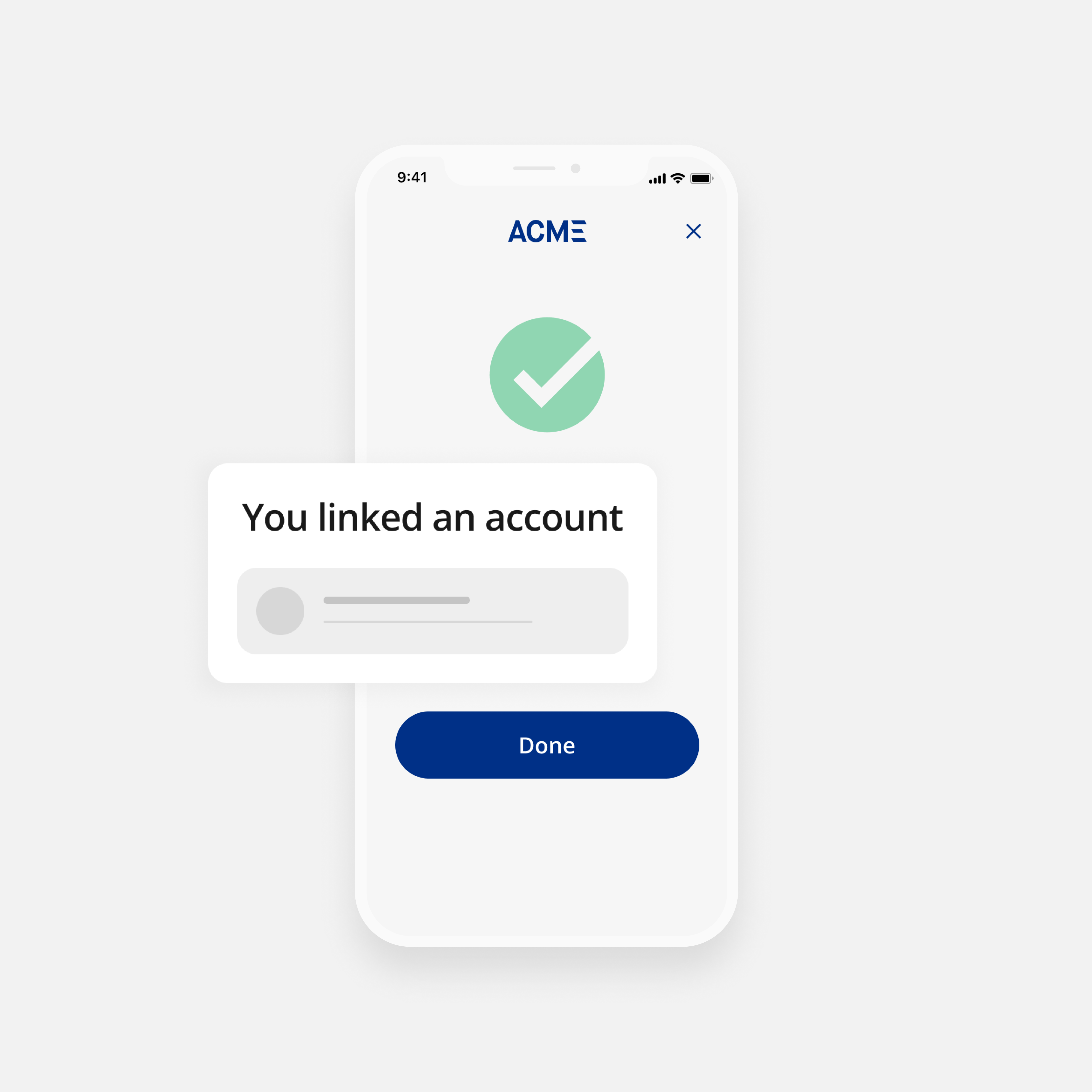

Real-time onboarding

Account and identity verification are key components of any onboarding process for financial services to meet regulatory standards and prevent fraud. Yet traditional methods like micro-deposits or manually submitting ID documents or bank statements are slow, costly, and unreliable. Any friction or delay in an onboarding flow will inevitably lead to increased drop-off, ultimately resulting in lost revenue.

Open banking lets you connect customer accounts via secure APIs and validate account information in less than 1 minute – giving users the seamless, real-time experience they have increasingly come to expect. For businesses, accessing account information lets you create next-generation onboarding and KYC flows, including age checks, identity verification, and source-of-funds checks. Plus, you can cut out the operational work involved in managing analogue, manual processes.

Not all account verification flows are created equal, though. You’ll want to find a partner that lets you fully customise the experience, providing a look and feel consistent with your brand and user journey to minimise user friction and drop-off. And to truly upgrade the onboarding experience you could combine account verification and pay-ins in one integrated open banking flow, reducing the overall number of steps.

Tink customers, on average, see a 20% increase in onboarding conversion rates when using our account verification technology. Try it out for yourself using our live demo.

Questions to ask your provider:

What are your average flow completion rates in markets X, Y, and Z?

Do you support integrated account verification (AIS) and payment (PIS) flows?

What customisation options are available?

Strong, reliable coverage

Last but certainly not least, a partner with strong bank coverage is a must for any investment platform looking to offer frictionless open banking experiences. Bank connectivity – the amount and quality of a provider’s connections to banks – underpins all of a provider’s product capabilities in crucial ways. The tricky part is that all providers tend to claim the broadest coverage and define what ‘coverage’ means in different ways.

We examined open banking coverage in detail in a recent post. To briefly recap: more bank connections means your service can reach more customers, but those connections are worth little if they’re not reliable and already battle-tested with large volumes. Coverage is not only a question of quantity, but quality too. You should be vetting potential open banking providers to ensure they manage all of their API connections in-house, regularly test and optimise, and operate at scale with real-world traffic.

At Tink we build and manage 100% of our bank connections in-house, and our engineering teams are dedicated to optimising performance and reliability. We handle over 1 billion monthly API calls with 99.9%+ uptime – you can check the current and historical status of our APIs here.

Questions to ask your provider:

What percentage of banks do you cover in markets X, Y, and Z?

What percentage of the banked population does this translate to?

What percentage of your connections are managed externally?

What’s your uptime?

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.