What is account aggregation, and what is it good for?

Simply put, account aggregation is about gathering someone’s financial data from a bunch of different accounts, so it can be collected or displayed in one place. Here’s how it can help people – and businesses – benefit from increased transparency.

Account aggregation is the process of gathering financial data from someone’s accounts.

It can include a broad range of financial accounts (like pensions and credit cards) – or be limited to a single institution, or to a certain type of account.

Aggregation increases transparency by helping people and businesses have a more complete view and better understanding of their finances.

You might also have heard of it as financial data aggregation, but it means the same thing: gathering the information from many – or all – of someone’s accounts to give better visibility over their finances. (Always and only with consent, of course.)

Account aggregation can come in many different formats. It can be limited to a single institution, or to a certain type of account. It can also be very comprehensive and include information on a wide range of accounts – from investments and pensions to credit cards and mortgages.

It all depends on how the aggregation is being done, and for what purpose.

What do consumers get out of account aggregation?

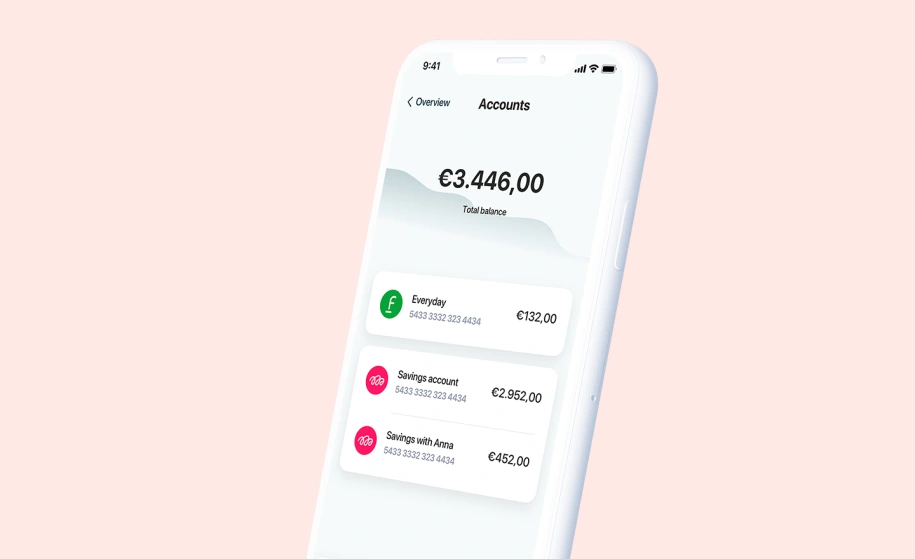

In most cases, the main benefit of account aggregation is that it helps people see all their different accounts in one place. This is particularly helpful for people that have their money spread out through different accounts (which is quite common).

So if someone has a salary account with bank #1, an investment account with bank #2, a mortgage with bank #3 – they can get a complete overview of their finances through a single app. Otherwise, they might need to log in to 3 different banks, and then keep a mental score of how much was in each.

What do businesses get out of account aggregation?

Businesses can benefit in the exact same way as consumers by using services that offer aggregation of business accounts. This is a simple way to get a better financial overview in case their funds are spread through different accounts.

However, businesses are more likely to get value by providing or leveraging account aggregation for their own customers.

Providing aggregation

Providing account aggregation can be a simple way to engage customers and keep their attention.

Let’s use the same example as above. If bank #2 lets their customer check all their accounts (including the ones they have with banks #1 and #3) in their app, the customer would probably use bank #2’s app more often than the others’.

Leveraging aggregation

There are also many types of businesses that can benefit from having increased transparency over their customer’s finances.

Lending companies are a great example. They can use aggregation to get quick, easy access to all their customer’s (or potential customer’s) financial data in order to make more accurate credit or risk assessments.

Having an easy way to access and understand the full picture of someone’s finances can help businesses in many ways, from saving time and increasing efficiency, to providing a better user experience in their digital channels.

Account aggregation in practice

Account aggregation technology is at the core of several of Tink’s products. Get to know a bit more about them:

Transactions uses aggregation to help businesses easily access financial data in a cleaned up and standardised format.

Money Manager offers personal finance management tools, and it leverages aggregation to provide a multi-banking experience that gives customers a more comprehensive overview of all their finances.

Account Check helps instantly verify account ownership by pulling up the account information straight from the banks.

Income Check helps seamlessly verify income by going through the user’s real-time transaction data.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.