How epap is using transactional data for sustainable finances

German startup epap is on a mission to reinvent the paper receipt with a digital and more sustainable way to keep track of them – all in one app. By partnering with Tink, epap can offer their users an easier and more efficient digital receipt experience. This gives consumers a complete overview of their spending and more control over their finances.

German startup epap is a digital receipt platform launched in 2020.

They’re helping retailers offer a sustainable alternative to printed receipts and have a new channel to enhance their customer loyalty.

epap is using Tink’s Transactions to categorise receipts and calculate spendings and income to give their users a truly holistic view of their finances.

Every year, UK retailers hand out around 11.2 billion till receipts, which cost at least £32 million to make. Even if you don’t need a receipt, chances are it’ll be printed anyway and go into the trash. The whole process can be wasteful. And in a digital world where everything is electronic, who wants to deal with a shoebox full of small papers? That’s where epap comes in.

Receipts reimagined

Digital receipt platform epap was launched in 2020. Their mission is to reduce environmental impact by developing a digital and sustainable alternative to paper receipts that will make receipts more useful and usable for consumers and retailers. With epap, users can collect all of their receipts in one place and manage their expenses in a better way. Also, retailers can offer a sustainable alternative to printed receipts and have a new channel to enhance their customer loyalty.

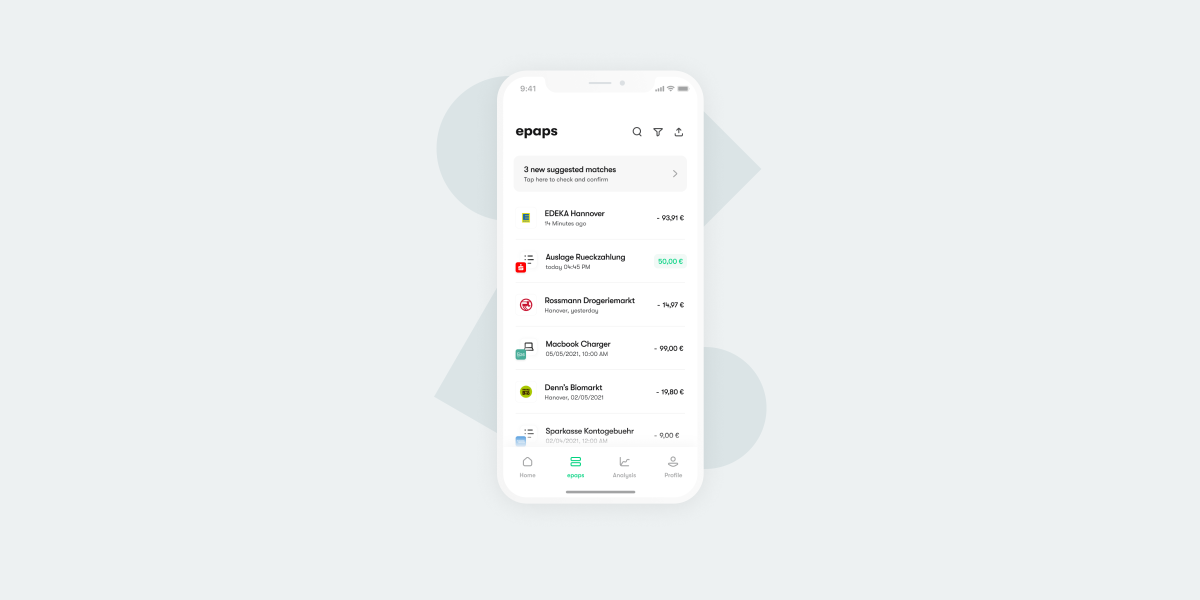

With epap, consumers can add digital receipts from over 4,500 stores across Germany via a QR code, scan a printed receipt into the app or receive a receipt or invoice via their email address. To make things even simpler, epap will automatically categorise the receipts and calculate spendings and income.

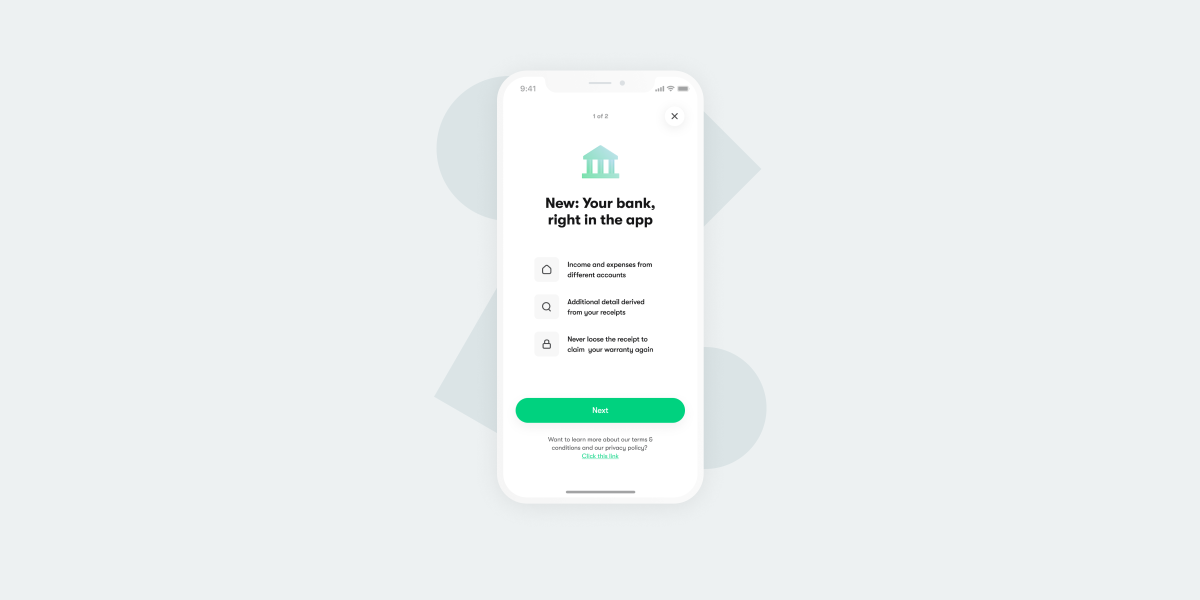

Connect your bank to the app

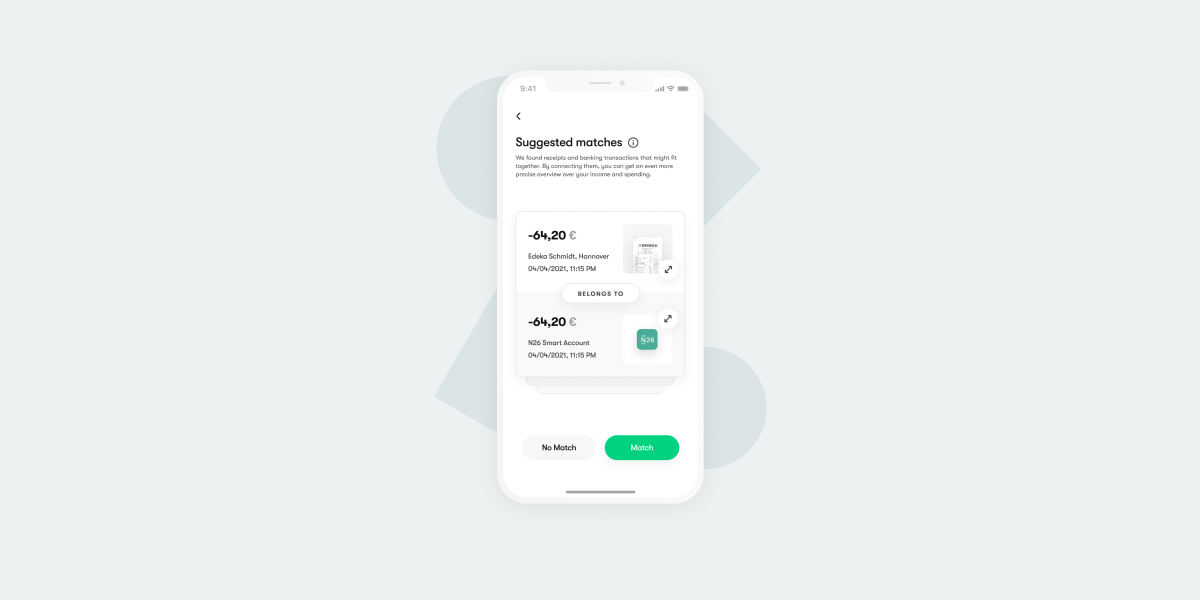

When a user connects their bank account, the receipts are automatically matched with the respective online banking transactions, offering a truly holistic overview. To make this possible, epap is teaming up with Tink.

Connecting the banks

By embedding Tink’s Transactions product into their app, epap users can connect to their bank account and fetch their transaction data in real-time. Users can get an overview of their balances and in the background, receipts and purchase history can be matched for simplified returns, easier expense reporting or have more control of their finances with a complete overview. Without Tink, all regular expenses would need to be manually imported into the app – which is time-consuming, cumbersome and overall not a great experience for the user.

To guarantee a user can seamlessly connect to their bank account to access real-time financial data, epap had to find the most friction-free way of aggregating data from banks across Germany – and in the beginning of next year, across Europe. That’s why they decided to partner with Tink.

‘We were amazed by the easy integration, the Tink console and the API with a massive focus on developer experience. Additionally, we thought of Tink as a great partner when expanding across Europe and from the start felt very supported by the team,’ says Fabian Gruß, CEO & Co-Founder at epap.

Scale up in Europe

The Tink platform gives access to financial data from more than 3,400 banks in 18 European markets through a single API, giving epap an opportunity to quickly and easily expand to other European markets in the future. By tapping into open banking, epap is unlocking new opportunities and allowing more consumers to get a more holistic, sustainable approach to receipts.

Want to learn more about Tink’s Transactions? Read our introduction guide or try the Transactions demo for yourself.

Do you have your own great idea of how to use financial data to make a difference? Try out the Tink platform – you can sign up for your own free account and start building today.

More in Use cases

2025-06-18

2 min read

Video – How Snoop is unlocking smarter saving with variable recurring payments

With the launch of variable recurring payments (VRP), Snoop is introducing a smarter, more flexible way for people to build their savings – and making the most of Tink's open banking solutions in the process.

Read more

2024-12-17

7 min read

User experience: Wealthify empowers customers’ financial wellness with Pay by Bank

Tink partner Wealthify uses Pay by Bank for the optimal PFM, investment and saving experience, thanks to easy account top ups and secure account-to-account payments.

Read more

2024-08-12

11 min read

Six ways open banking helps remittance

Learn all about remittance, and how open banking can help it happen more smoothly with six of our best tips. From reducing friction, to simplifying compliance processes, and much more.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.