Why digital banking services need partners outside banking

Digital transformation is constantly evolving, and consumers today are more mobile first than ever. This creates sky-high expectations on mobile services, pressuring banks and other businesses to meet demand through ramped up digital services. By both adding open banking-powered features to your offering and plugging into tools from partners outside the scope of banking, you’re one step closer to surpassing expectations.

Service providers from outside the banking industry, though within a bank’s ecosystem, are effective partners when going mobile first in the battle for consumer attention.

An ecosystem service provider can help banks broaden consumer choice across sustainability, contract management and more.

Benefits of partnering with non-banking services include increased engagement, product awareness and faster innovation.

As a financial institution, offering additional services beyond those that consumers expect is an effective way to maximise engagement, meet needs and stay relevant. One way to ramp up quickly and stay ahead of the game is through embedding third-party service providers from the tech ecosystem.

What is an ecosystem provider?

Teaming up with a service provider outside banking – but within the banking industry’s ecosystem – enables financial institutions to leverage additional, existing and best-in-class services rather than building new products and services from scratch. This could be done either by partnering up with several different independent providers – or making it easier and partnering up with a platform like Tink, already partnered with ecosystem providers offering services sought after by consumers through the Tink platform.

What could additional services look like?

The list of ecosystem providers – and therefore the number of different services possible – is long. Here are some increasingly in-demand features that are bound to help you meet your customers’ expectations.

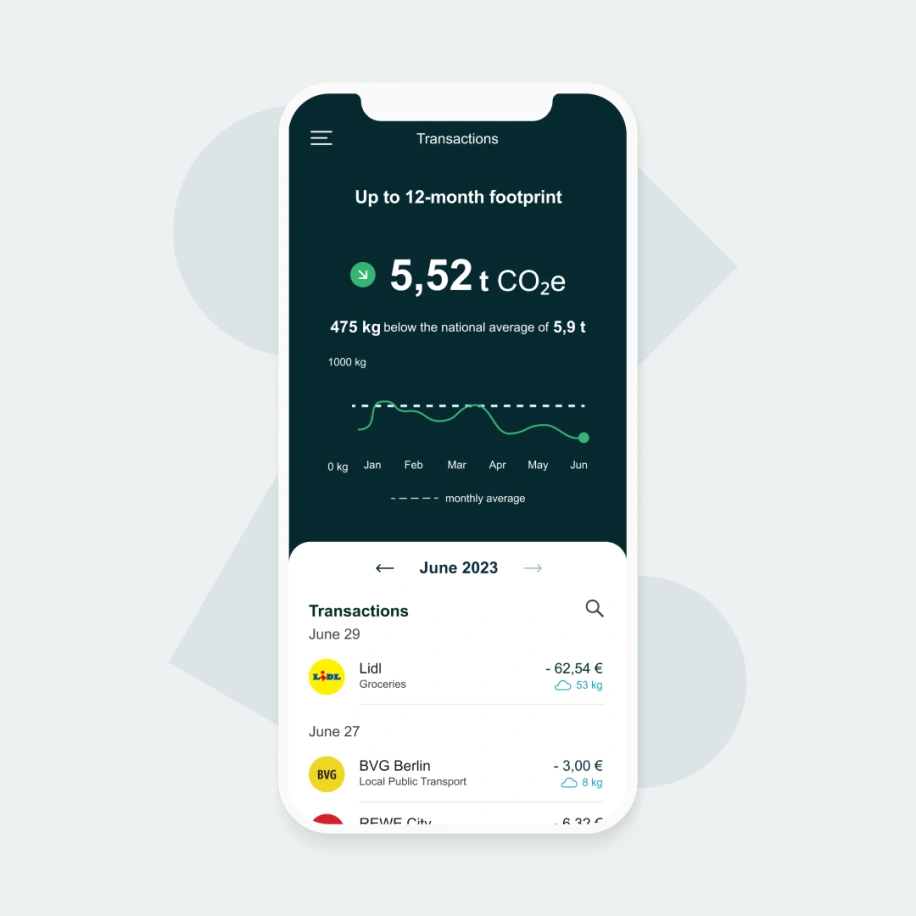

Power your app with sustainability coaching. 62% of consumers want more information about their carbon footprint so they can reduce their environmental impact. Meet that need by offering CO2 tracking based on each daily transaction, to give consumers insights on how their spending impacts their carbon footprint.

Tink is joining forces with ecolytiq, a climate engagement solution. With ecolytiq’s sustainability-based services to be embedded in the Tink platform, customers will get an overview of their environmental impact and a holistic coaching experience across both spending and sustainability – right in their mobile banking app.

By adding sustainability features in your banking app, users get the context needed to understand both their financial habits and the impact of their spending on the environment.

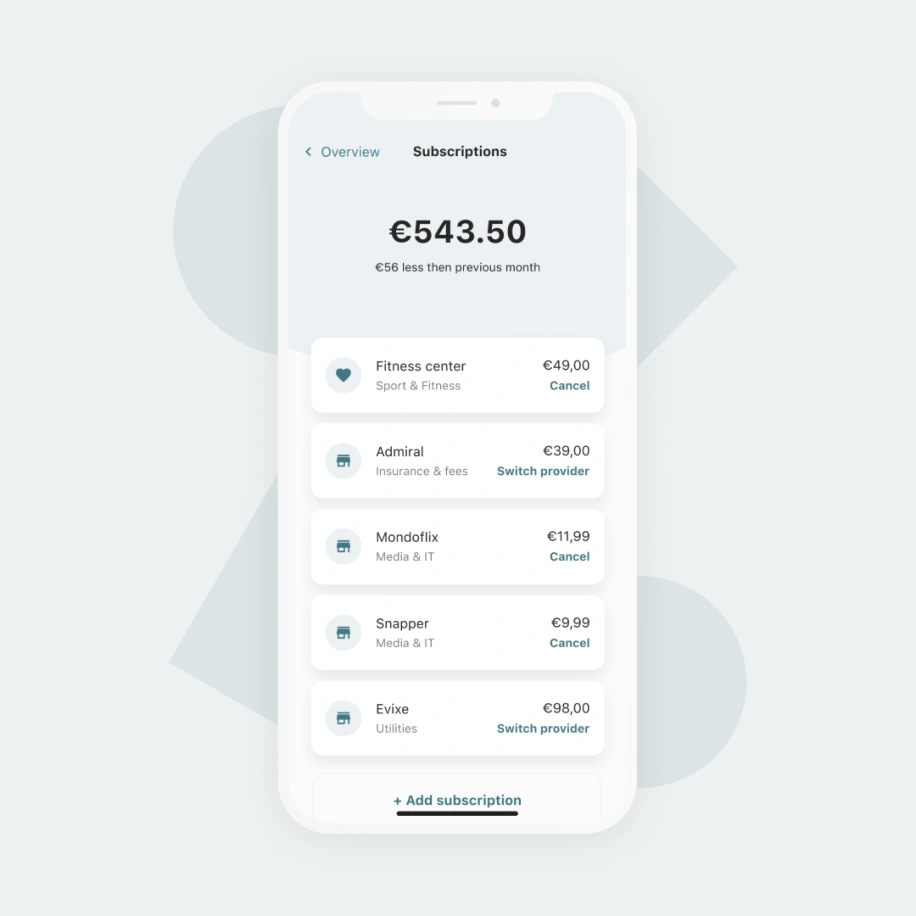

Streamlined subscription management for your customers. Embedding contract management helps you add value for consumers – partners that provide subscription switching or cancellation make it possible to provide an overview of contracts and fixed costs. Combined with Tink's pattern recognition technology, consumers can view their subscriptions, compare other offers on the market and choose to cancel their contracts directly in their digital banking app. As a bank, adding a subscription manager into digital banking services helps your users get one step closer to controlling their spending. By receiving notifications of, for example, the past two months’ increased energy costs, bank customers can log into their banking apps, check past subscription transactions and then decide to cancel them if needed – or switch to other providers.

Why adding services beyond banking is good for business

Increased consumer engagement

Adding additional services beyond banking is an effective way to meet more consumer needs and boost consumer engagement, by adding more value to your digital banking app. Offering more engaging features and services encourages consumers to return to your banking app – and use it for more than their financial overview.

Innovation with quick time to market

Enable quicker innovation by having all the heavy lifting done for you. The data is processed in the background, while you are presented with an easier integration in a plug-and-play manner. This not only increases your operational efficiency, but also allows you to innovate and scale your digital banking app with quicker time to market.

Activate customer interest in more of your services

By providing additional value and increasing the number of interactions and time spent within the app, you have the opportunity to introduce users to even more of your digital banking services.

Interested in getting more services integrated with your banking app? Tink’s Data Enrichment product enables plug in with ecosystem partners through the Tink platform to accelerate your digital banking offering. Learn more about Data Enrichment or get in touch.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.