2024-10-01

4 min read

Meet Merchant Information: providing bank customers with elevated transaction visibility

Tink has today launched Merchant Information, a solution of our Consumer Engagement offering which provides consumers with more detailed information about their transactions.

Read more

2024-09-03

5 min read

Customer interview – Nordea on consumer engagement

We spoke to Nordea Product Manager Sami Mikkonen about enhancing their mobile app using open banking technology, focusing on improving consumer engagement and financial management.

Read more

2024-08-20

7 min read

UK bank customers could be almost £24.5 billion better off per year – through the power of digital financial management tools

Tink’s new research is telling for banks, revealing that consumers now demand more digital financial management tools to support their personal finance goals.

Read more

2024-08-05

5 min read

Feature update: Savings Goals elevates your money management experience

Reaching financial goals can be daunting – so we’ve updated Savings Goals, a feature of Tink Money Manager designed to help banks empower customers to proactively save and achieve financial wellness.

Read more

2024-07-17

2 min read

Banking on engagement

This Tink white paper introduces new consumer and retail banking executive research from key European markets, setting the scene for banks to take the next step with Personal Finance Management (PFM).

Read more

2024-06-20

6 min read

Engaging Gen Z: Tink’s new data on the biggest challenge for bankers in 2024

Tink’s new data identifies Gen Z as key for the banking industry, highlighting the importance of ensuring digitised, personalised features – read more and access the complete research here.

Read more

2024-05-30

5 min read

Meet Variable Spend: our latest feature for intelligent expense tracking

Expense tracking can be detailed as well as intuitive – say hello to Variable Spend, a new feature of Tink Data Enrichment designed to help banks offer their customers more insight.

Read more

2024-02-27

4 min read

Meet Jack Spiers – Tink’s new UK&I Banking & Lending Director

We spoke to Jack about working with some of the largest financial institutions in the world, optimising our banking relationships together with Visa, and what excites him about the future in our industry.

Read more

2024-01-02

8 min read

2024 – what’s on the horizon for payments and data-driven financial services?

From Pay by Bank and VRP, to risk assessments, sustainability and money management tools, 2024 looks set to be the year when data-driven financial services hit the mainstream.

Read more

2023-11-17

8 min read

Savings Banks Group takes the stage with Tink at Nordic Banking Forum 2023

Open banking tools like Tink Money Manager and Tink Data Enrichment help its partners, like Savings Banks Group, offer streamlined user experiences that coach consumers towards financial wellness.

Read more

2023-09-21

3 min read

Meet Christophe Joyau, Tink’s Senior Vice President of Banking & Lending

Christophe Joyau has played a crucial role in our transition from serving individual customers to business customers and building a B2B SaaS function – he told us about it and what it’s like working with Visa.

Read more

2023-09-12

3 min read

Scaling your services: how to offer your customers financial coaching

Help your customers manage the cost of living with open banking technology like Tink Data Enrichment, and offer them personalised financial coaching.

Read more

2023-08-08

4 min read

An Post releases free money management services with extended Tink partnership

An Post now offers free money management services to all by deepening its partnership with Tink. Just 16 months after joining forces, the An Post Money smart budgeting tool is available to everyone in Ireland, expanding access to the service beyond An Post Money customers.

Read more

2023-07-27

6 min read

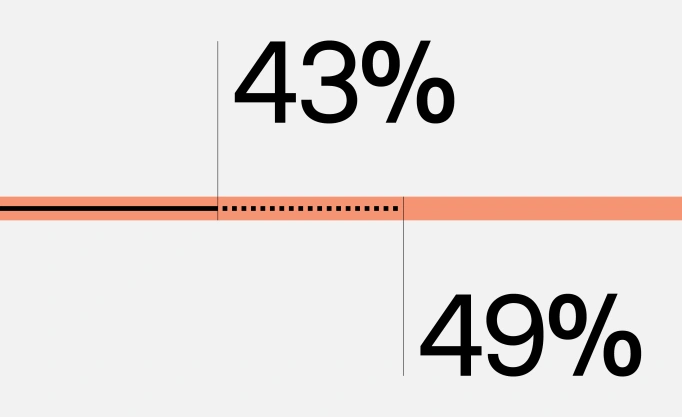

Banks step up financial management support as Brits seek help to navigate the cost-of-living crisis

New findings reveal an opportunity for banks to enhance consumer support by continuing to develop, and raise awareness of, data-driven financial services.

Read more

2023-07-19

7 min read

Financial wellness coaching – how to personalise your digital banking services

Take personalised digital banking into the future with Tink’s Data Enrichment and Money Manager products, based on real-time data and bleeding edge open banking technology.

Read more

2023-07-17

5 min read

Why digital banking services need partners outside banking

Learn why banks need tech partners and ecosystem providers to engage customers, increase loyalty and meet consumer sustainability expectations.

Read more

2023-07-05

2 min read

Make smarter risk decisions with our comprehensive new tool

We have introduced a new feature on the Tink Console called Risk Decisioning, which provides a consolidated risk experience to enhance affordability and risk assessments.

Read more

2023-06-29

5 min read

European Commission introduces PSD3/PSR to advance open banking and strengthen consumer protection

Tink’s Head of Industry & Wallets, Jan van Vonno, discusses the EU's draft legislation for financial services - PSD2's impact, open banking progress, consumer protection, and benefits of the upcoming PSD3/PSR.

Read more

2023-06-21

5 min read

Customer demand for banking tools to track sustainability outstripping supply

New research from Tink shows that an estimated 40% of Brits would like to track their environmental impact through a service provided by their bank – but only 24% of banks currently offer the tools to do this.

Read more

2023-04-21

5 min read

BNPP Fortis: safeguarding customer trust with budget management tools

An interview with BNP Paribas Fortis' Director of Channels and Customer Experience, Emilie Jacqueroux, on how the bank supports financial wellbeing by providing money management tools to adapt to the cost-of-living crisis.

Read more

2023-04-20

4 min read

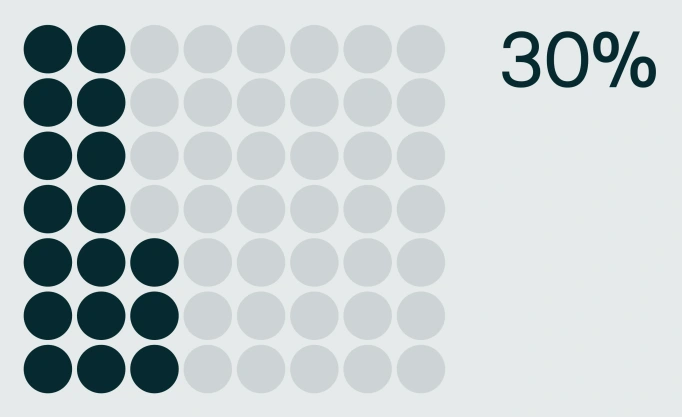

Nearly one in four Brits in need of tailored financial support

Tink's latest research shows that almost one in four Brits are in need of tailored financial support. Learn how open banking can help UK banks support financially vulnerable consumers during the cost-of-living crisis.

Read more

2023-04-14

5 min read

How to turn data into personalised customer experiences with categorisation

Data categorisation helps banks clean and categorise transaction data to build better digital banking services, personalise customer experiences and encourage financial wellness. Here’s how to use Tink’s Data Enrichment.

Read more

2023-03-20

6 min read

How banks can offer tailored support to different consumer groups

Different consumers need differing levels of support. Learn how banks can support UK consumers through the cost-of-living crisis by using tailored financial coaching, data-driven tools and money management solutions.

Read more

2023-02-09

6 min read

Half of Brits fear budget shortfall – here’s how banks can help

Tink’s latest research shows that a staggering 25 million Brits fear their income soon won’t cover essential costs, meaning banks have the opportunity to support them with tailored banking solutions.

Read more

2023-01-26

4 min read

Meet Data Enrichment: the engine that elevates your banking app

Tink launches Data Enrichment, a new product giving banks the speed and flexibility to innovate digital banking apps, engage customers with PFM and keep them coming back.

Read more

2022-12-13

4 min read

How to unlock growth through consumer engagement

Consumer engagement is a crucial component when delivering products and services. Discover the strategies that can help power growth for your business.

Read more

2022-11-28

6 min read

How Money Manager helps you boost customer loyalty

Personalisation is essential to engaging customers and building loyalty for banking apps. Tink’s Money Manager has the features to help.

Read more

2022-11-24

5 min read

Balance Check

Reducing fraud and failed payments just got easier. Learn how balance check is increasing operational efficiency and reducing chargebacks.

Read more

2022-11-17

2 min read

Open banking solutions to meet digital-savvy customer expectations

The modern customer expects more from their service provider than ever before. Discover how open banking can help you satisfy their needs in our ultimate solutions guide.

Read more

2022-10-11

5 min read

How evolving digital expectations are creating new opportunities for banks

With Tink’s Data Enrichment, banks gain access to enriched and personalised consumer spending insights – enabling them to better support their customers’ digital needs.

Read more

2022-07-27

6 min read

3 easy ways to turn financial data into value

The democratisation of financial data is opening up new opportunities. Find out how to harness its power with open banking in our latest article.

Read more

2022-05-24

5 min read

How banks can add value for their customers with recurring transactions

With so many subscription services popping up, consumers are losing control of their recurring costs. Find out how banks can leverage open banking – and Tink’s data enrichment capabilities – to help them better manage their finances.

Read more

2022-03-31

7 min read

Young people in the UK call for banks to help them go green

Tink research finds that 18-34 year olds in the UK want more information on their carbon footprint, and place high expectations on banks to help them track and improve it. With open banking, financial institutions can meet this demand.

Read more

2022-03-15

6 min read

Behind the scenes of an award-winning open banking partnership

Tink partner NatWest was awarded the Celent Model Bank 2022 Award for its Digital Spending feature. We talked to partnership insiders to get their views on the collaboration, and what it takes to build a successful partnership.

Read more

2022-01-19

3 min read

NatWest, Cogo and Tink: a three-way partnership to boost sustainability

NatWest enlisted the help of both Tink and Cogo to offer a carbon tracking feature for their climate-conscious customers. Here’s how it works – and why Tink and Cogo joined forces to bring other similar solutions to market.

Read more

2021-11-23

2 min read

Open banking investments and use cases

How has the pandemic impacted open banking budgets? How much did financial executives invest in their open banking objectives? And which opportunities do they have in sight? We surveyed bankers across Europe to find out.

Read more

2021-09-21

3 min read

Bankers embrace the open banking revolution – but expect a long journey ahead

Financial executives in Europe see open banking as a revolution, and are embracing it more than ever. But many expect it will take several years to get there. While transformation takes time – there could be a way to accelerate it.

Read more

2021-09-01

6 min read

New priorities for bankers – and how open banking can help

Banking priorities have changed as a result of the pandemic. Discover the three focus areas that are top of mind for financial executives – and how open banking can help institutions tackle all three by leveraging financial data.

Read more

2020-10-07

3 min read

3 tips for staying ahead of the curve in the open banking shift

To stay ahead of the curve and master the open banking transformation, bankers need to start looking beyond compliance, and be smart about where to invest.

Read more

2020-09-16

4 min read

5 open banking use cases European bankers are most investing in

Our newly released survey report takes a closer look at open banking use cases, and which opportunities financial executives across Europe are most anticipating. Get to know more about the top five picks.

Read more

2020-04-23

4 min read

The growing positivity towards open banking in Europe

The first report based on our survey of 290 senior executives and decision makers in the financial industry across Europe is out. Find out what the results reveal about how bankers are tackling the open banking opportunity.

Read more

2020-02-13

5 min read

Building a successful bank and fintech partnership: the CGD story

Bank and fintech partnerships are booming as the shift in the financial industry is taking everyone in the same direction. But just like with any other relationship, a happily ever after is not always a given. We’ve previously shared tips from our own experience in building successful partnerships, but we were curious to get the bankers’ perspective. So we reached out to our partners at CGD for their take on it.

Read more

2020-01-23

2 min read

Tink becomes BNP Paribas’ preferred tech partner in Europe

BNP Paribas, the world’s eighth-largest bank, has selected Tink to be its preferred European partner for data aggregation and enrichment, payment initiation and personal finance management (PFM) technology – bringing our banking infrastructure and data services to the bank that serves 18 million customers in the region.

Read more

2019-10-02

4 min read

How CGD built a cutting-edge PFM app in 6 months

Portugal’s biggest bank, Caixa Geral de Depósitos (CGD), wanted to transform how it interacted with its customers. So it asked Tink to help build a first-class mobile experience that would also leverage open banking tech. Six months later, CGD launched a brand-new PFM app to give millions of consumers unprecedented insight into their economy.

Read more

2019-09-26

5 min read

The opportunity of a century in banking is here

The financial industry has been standing at the precipice of this major shift. Some banks have taken the leap – innovative thinkers and leaders embracing the data revolution and using it to deliver amazing services. For those who’ve waited, now is your time – to take a leap, redefine how consumers manage their money and seize a once-in-a-lifetime opportunity to change banking for the better.

Read more

2019-09-10

8 min read

5 ways customer’s banking expectations are changing

From the demise of cash and physical bank branches, to the rise of digital banks and automation, technology is irreversibly changing the way we manage our money – and what we expect from the services that do.

Read more

2019-08-15

3 min read

How NatWest is using Tink to engage more customers

In our first UK partnership, we’re helping NatWest use open banking tech to transform its mobile banking app, and improve how customers manage their money.

Read more

2019-07-30

4 min read

How partnering for tech allows ABN AMRO to be more productive

In our recent open banking report – Inside the minds of Europe’s bankers – we quizzed nearly 270 financial executives across Europe, and sat down with some of the leading minds in the field to get to the bottom of the biggest challenges, threats and opportunities of open banking.

Read more

2019-03-03

8 min read

How to build customer trust and loyalty through better PFM experiences

Winning the customer of the future will require a level of personalisation and insight that doesn’t currently exist in banking. But it’s coming – and we’re building the platform that will deliver it. Our PFM solutions use machine learning to offer tailored, actionable advice that guides customers to the financial future they envision – and creates long-term relationships.

Read more