UK bank customers could be almost £24.5 billion better off per year – through the power of digital financial tools

Tink’s new research is telling for banks, revealing that consumers now demand more digital financial management tools to support their personal finance goals. This is against a backdrop of 75% of consumers surveyed being conscious of increased prices amidst the cost-of-living crisis. Read on to find out more about the tools that can empower bank customers while building engagement and loyalty.

Tink’s new research is telling for banks, revealing that consumers now demand more digital financial management tools to support their personal finance goals.

Consumers across the UK who are using digital financial management tools report being on average £37.08 better off per month, or £445 better off per year, compared to pre-adoption, according to our new research.

Read on to find out more about the tools that can empower bank customers while building engagement and loyalty.

Consumers across the UK who are using digital financial management tools report being on average £37.08 better off per month, or £445* better off per year, compared to pre-adoption, according to our new research. Today, as many as 7.6 million** Brits are already using digital financial management tools, meaning this group is gaining up to a total of £3.38 billion*** collectively each year.

If we broaden this out, and every person in the UK over the age of sixteen started using digital financial management tools, this could represent the equivalent of a potential extra £24.5**** billion going into consumer wallets each year.

Consumers using digital financial management tools to improve financial health

Tink’s research comes at a time when an estimated three quarters (75%) of consumers surveyed across the UK say they are mindful about what they buy because the cost of goods is so high.

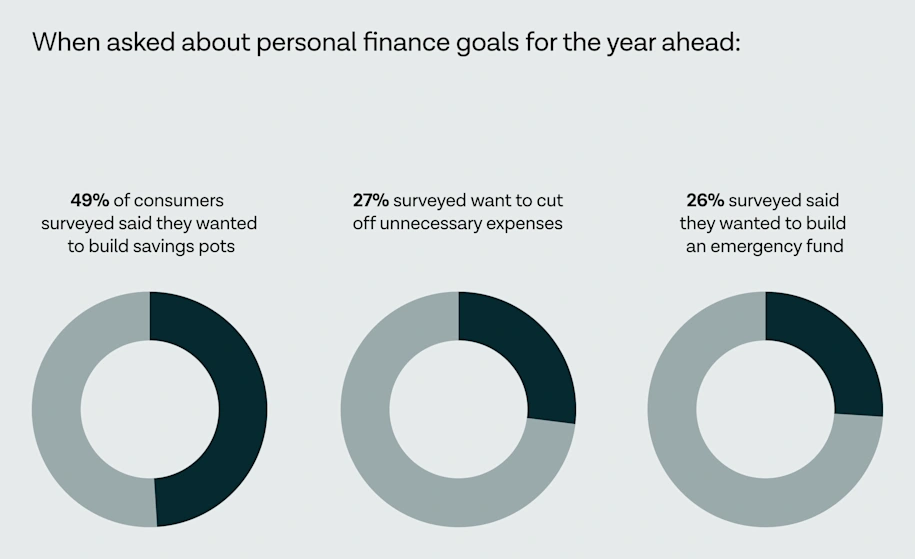

When asked about personal finance goals for the year ahead, almost half of consumers surveyed said they wanted to boost savings pots (49%). More than a quarter surveyed want to cut off unnecessary expenses (27%) or build an emergency fund (26%).

It’s therefore no surprise that consumers are using the money saved through digital financial management tools to work towards these personal finance goals. Over a third (39%) of those surveyed used the extra funds to increase their savings contributions and almost one in four (23%) paid down their debt.

This suggests a clear link between using these services and improved financial health.

Building engagement and driving long-term loyalty with money management tools

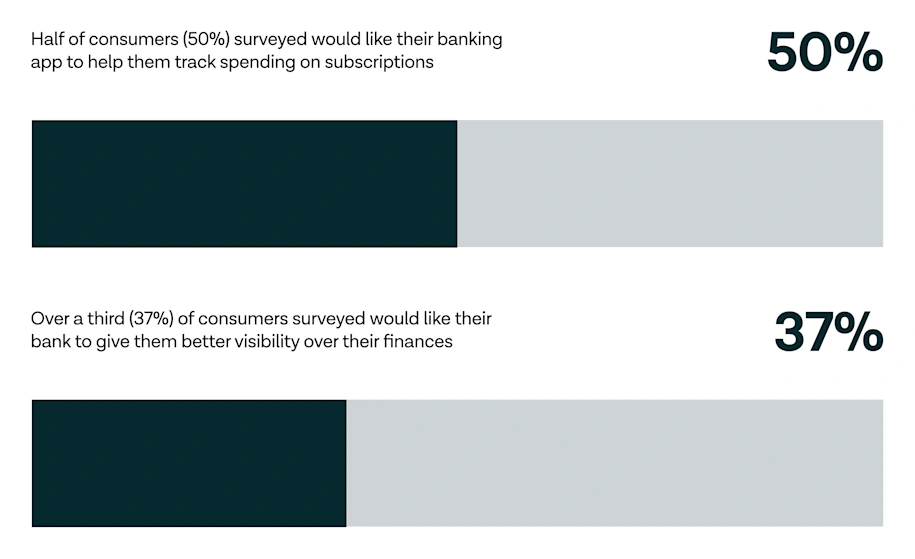

Banks seeking a competitive edge have an opportunity to capitalise on clear consumer demand for digital financial management tools. Half of consumers (50%) surveyed would like their banking app to help them track spending on subscriptions, and over a third (37%) would like their bank to give them better visibility over their finances.

The survey also suggests that some consumers are more likely to consider switching banks to gain access to better support and tools to help them manage their finances. Over a third (36%) of respondents say they would switch to another bank if it provided them with tailored support to meet their financial goals. A similar number (32%) would switch to another bank if it provided them with tools to track and manage their spending.

As well as driving loyalty and engagement, respondents from a separate Tink survey of banking executives reported additional benefits from providing these services. Almost half (46%) of banks offering digital financial management tools reported seeing increased ‘top of wallet’ behaviour in consumers – such as greater card usage and higher payment volumes.

“It’s clear that financial management tools can make a material difference to a consumer's finances. In addition to improved financial health, our research shows consumers have also reported a wide range of wellbeing and lifestyle benefits. These vary from reduced stress levels to increased happiness, as well as less time spent on managing money,” says Jack Spiers, Banking & Lending Director for the UK&I at Tink.

“At the same time, there are clear advantages to banks offering these tools to their customers. In a competitive retail banking market, banks have an opportunity to differentiate their offer and meet evolving consumer expectations by helping their customers better manage their finances,” Jack continued.

“At Tink, we can see this benefit first hand. Our banking partners tell us they’ve seen a positive impact on customer engagement and satisfaction as a result of adopting our suite of digital financial management tools.”

Curious about tools that help you leverage open banking to build customer loyalty? Discover the possibilities with Tink Data Enrichment, or reach out to our team.

_

*Calculated by multiplying the monthly mean of £37.08 by twelve.

**Calculated on the basis that the 16+ UK population figure is 55,190,347, as reported on by the ONS 2022 midyear estimates. When surveyed, 13.8% of UK consumer survey respondents said they were “aware of digital financial management tools and already use them”.

***The number of people aware of financial management tools and using them as calculated in (3) multiplied by the monthly mean saving of £37.08.

****Calculated by multiplying the monthly mean of £37.08 by twelve and then multiplied on the basis that the 16+ UK population figure is 55,190,347, as reported on by the ONS 2022 midyear estimates.

Banking research was conducted by Censuswide on behalf of Tink in May 2024 amongst 101 retail banking executives who are based in the HQ function (aged 18+).

Consumer research was conducted by Censuswide on behalf of Tink in May 2024 amongst a nationally representative sample of 2,010 consumers aged 16+ in the UK. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Tink does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.

More in Tink news

2025-07-01

2 min read

Tink and Chip partner to power seamless account top-ups with open banking

Chip, the award-winning wealth app, is now using Tink’s open banking technology to offer users a faster, more secure way to top up their accounts.

Read more

2025-05-28

2 min read

Tink and Adyen partner to bring Pay by Bank to Vodafone customers in Germany

Tink and Adyen have announced a partnership with Vodafone, a leading telecoms company, to offer their customers in Germany the option to pay their prepaid tariff and outstanding postpaid balances using Pay by Bank.

Read more

2025-03-20

4 min read

Tink hits 10,000 merchant milestone for open banking payments

As the adoption of open banking payments surges, we've hit a new milestone as 10,000 merchants choose Pay by Bank – plus a new €100M daily peak for our payment initiation services

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.