Engaging Gen Z: Tink’s new data on the biggest challenge for bankers in 2024

Young consumers are choosing feature-rich banking experiences, and for an estimated 67% of UK banking executives, this demographic is key to future proofing their business, according to Tink’s new research. Here's what the newest generation of borrowers expect – and why tailoring tools can build their loyalty.

Tink’s new research indicates that banking executives view younger demographics as key, while 31% of Gen Z consumers surveyed would change banks without an upgrade to digital tools and services

An estimated 57% of Gen Z consumers want their bank to provide more visibility over their day-to-day finances

72% of banking executives surveyed wish to develop digital financial tools that support customers, but the majority face development and implementation challenges.

More than half (57%) of banking executives surveyed across the UK say that attracting young consumers is one of the biggest challenges they face in the next twelve months, according to our new research.* An estimated two thirds (67%) say it is a vital part of future proofing their business, with 50% believing that it’s key to remaining competitive.

This insight comes against a backdrop of high demand from Gen Z consumers for feature-rich banking experiences – with a greater likelihood of switching their loyalty to another provider if they don’t get them.

Gen Z hearts prove hard to capture

Nearly half (46%) of Gen Z consumers surveyed are already using third-party money management apps in addition to their core bank, indicating that consumers are increasingly turning to other providers to help them understand their finances. In fact, an estimated 31% of Gen Z said their bank was at risk of losing them as a customer if digital tools and services weren’t upgraded.

Tink’s research finds that Gen Z consumers could be lured away to competitors by the offer of tailored support in meeting financial goals (49%) or tools to manage spending (48%). Most importantly, Gen Z consumers would like to see their primary bank provide more visibility over finances (57%) and help them manage the cost of living (55%). This indicates that tangible support with day-to-day finances is clearly top of mind for Gen Z.

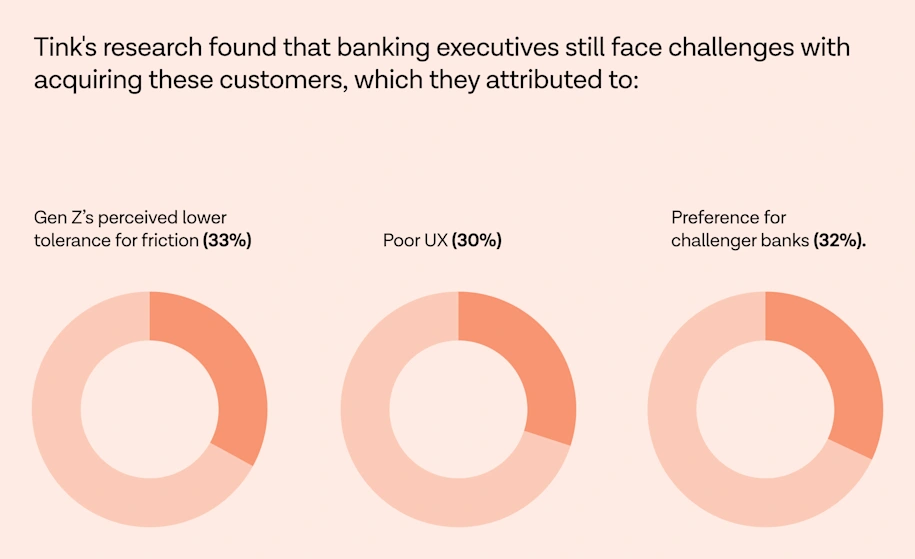

There was also recognition by executives that banks need to up their game to win over younger consumers, with 63% surveyed acknowledging that younger generations expect more and new innovative products and services from them. Yet the research found that banking executives still face challenges with acquiring these customers, which they attributed to Gen Z’s perceived lower tolerance for friction (33%) or poor UX (30%), and preference for challenger banks (32%).

Using money management tools to drive long-term loyalty

As a result of younger consumers’ rising expectations, Tink’s research shows banks want to take action to invest in digital financial management tools as an effective way to attract and retain customers.

Over three quarters (79%) of banking executives believe that banking apps or online banking features, like money management tools, are effective for customer acquisition. A similar number (74%) agree that digital financial management tools are also helpful in retaining customers.

It’s no surprise then that 72% of surveyed banking executives said that developing financial management tools that support customers is a top priority. However, some implementation challenges remain, with 70% of banking executives surveyed believing that growing customer demand outstrips their current development ability.

“Banks are understandably keen to attract younger customers and become their provider of choice throughout their lifetime. Therefore, many are focused on keeping up with evolving consumer expectations of this younger cohort, to deliver the digital financial management tools which will win them over,” says Jack Spiers, Banking & Lending Director for the UK&I at Tink.

“More than ever, retail banks have an opportunity to focus their long-term strategies on keeping customers engaged. Continued strong competition in the retail banking market is offering consumers a myriad of options and providers to choose from,” Jack continued.

“To future proof their business in the long term, banks can invest now in upgrading their digital offerings. As competition grows from fast-moving challenger banks and third parties, greater collaboration with trusted third-party partners can help banks bring innovative products to market at greater speed and scale.”

Curious about tools that help you leverage open banking to build customer loyalty? Discover the possibilities with Tink Data Enrichment, or reach out to our team.

—

*About the research

Banking research was conducted by Censuswide on behalf of Tink in May 2024 amongst 101 retail banking executives who are based in the HQ function (aged 18+).

Consumer research was conducted by Censuswide on behalf of Tink in May 2024 amongst a nationally representative sample of 2,010 consumers aged 16+ in the UK.

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Tink does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.

More in Tink news

2025-07-01

2 min read

Tink and Chip partner to power seamless account top-ups with open banking

Chip, the award-winning wealth app, is now using Tink’s open banking technology to offer users a faster, more secure way to top up their accounts.

Read more

2025-05-28

2 min read

Tink and Adyen partner to bring Pay by Bank to Vodafone customers in Germany

Tink and Adyen have announced a partnership with Vodafone, a leading telecoms company, to offer their customers in Germany the option to pay their prepaid tariff and outstanding postpaid balances using Pay by Bank.

Read more

2025-03-20

4 min read

Tink hits 10,000 merchant milestone for open banking payments

As the adoption of open banking payments surges, we've hit a new milestone as 10,000 merchants choose Pay by Bank – plus a new €100M daily peak for our payment initiation services

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.