Meet Data Enrichment: the engine that elevates your banking app

Today we’re introducing Data Enrichment, a new product to help Tink users deepen customer relationships. The pressure is on for financial institutions to meet rising consumer expectations on digital banking apps. Tink Data Enrichment adds value to financial data, helping banks build engaging services that surpass customer expectations – with quick time to market.

Tink launches Data Enrichment, a new product giving banks the speed and flexibility to meet rising consumer expectations.

Tink Data Enrichment is the engine and data processing layer of personal finance management (PFM), transforming complex financial transactions into holistic customer profiles.

This product helps banks hyper-personalise each customer’s experience to keep them coming back.

With great digital transformation comes great consumer anticipation. This adds to the struggle for many financial institutions to maintain and scale their digital banking offering, while keeping customers engaged and satisfied in the long run.

The challenge of leveraging financial data

To keep customers satisfied with digital banking, really getting to know their needs is essential to giving them the right insights and features. Even though banks have a lot of data about their customers, they often lack a holistic view of their financial engagement and transactions. Extracting value from data in its raw form and then using it effectively can be difficult and demands a lot of effort, which means that it requires competencies and time that generate high costs.

Why Data Enrichment?

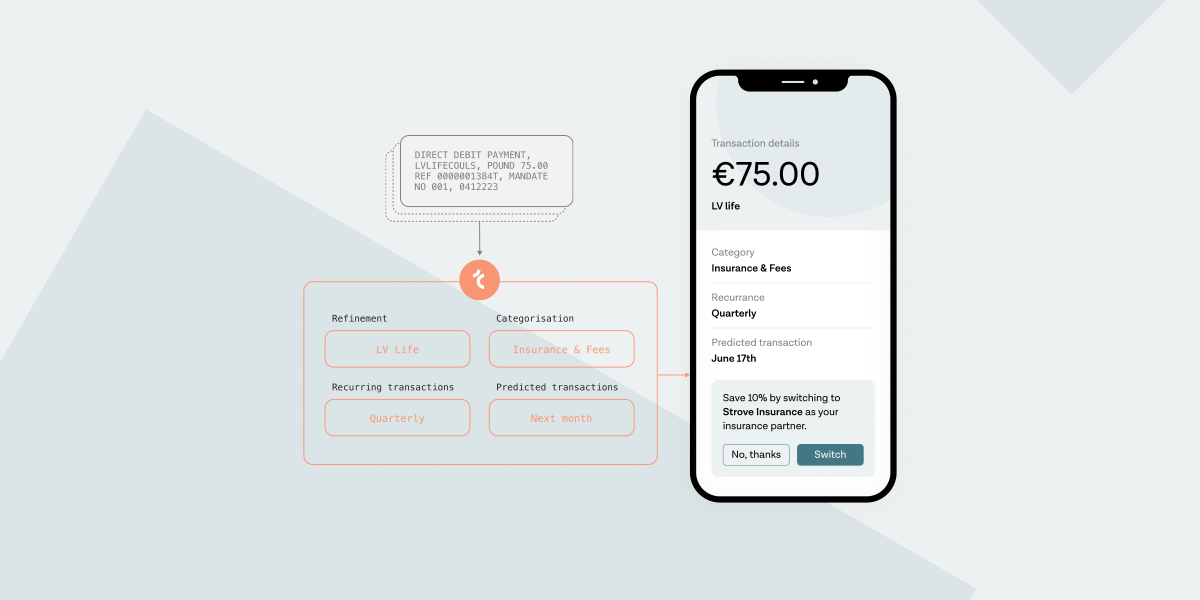

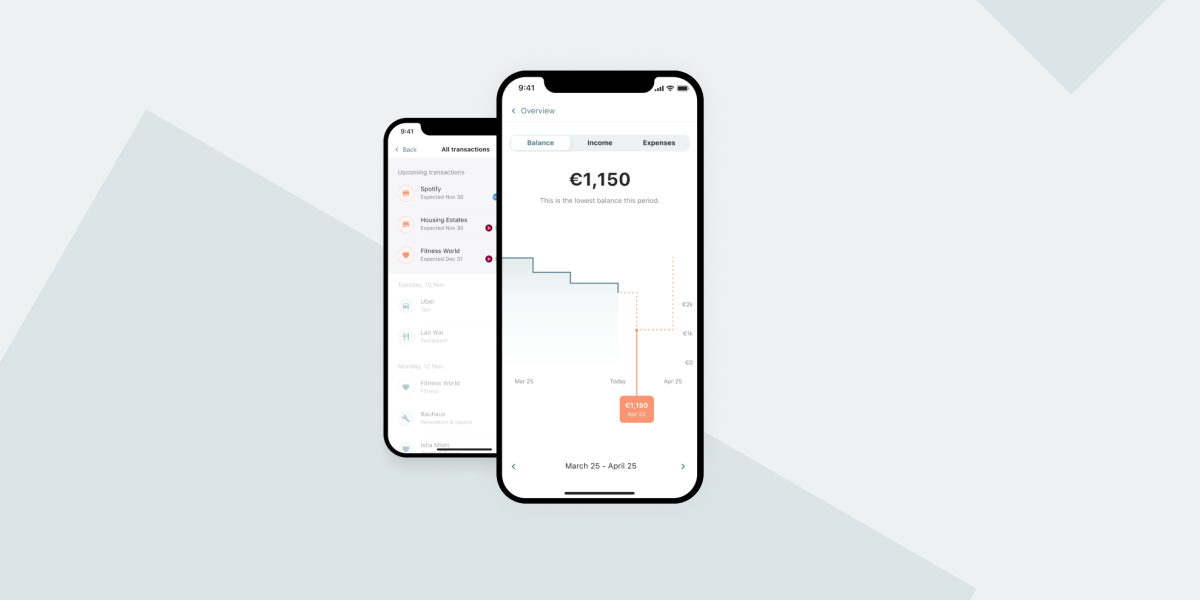

Tink Data Enrichment is designed to take the weight off banks’ shoulders. Gone are the days of being unable to leverage data quickly enough. Data Enrichment is the engine and data processing layer of personal finance management (PFM), helping banks turn financial transactions into holistic sources of information about consumers. Through processing and enriching raw transactions as well as categorising them to identify patterns and recurrences in consumer spending behaviour, Data Enrichment provides the speed and flexibility to build innovative features on top of a bank’s data. The result? The ability to meet rising customer needs and provide them with a more accurate financial overview thanks to complete, understandable data.

What are the benefits?

The building blocks of Data Enrichment consist of a set of capabilities that can power different use cases, depending on a bank’s – and their consumers’ – needs.

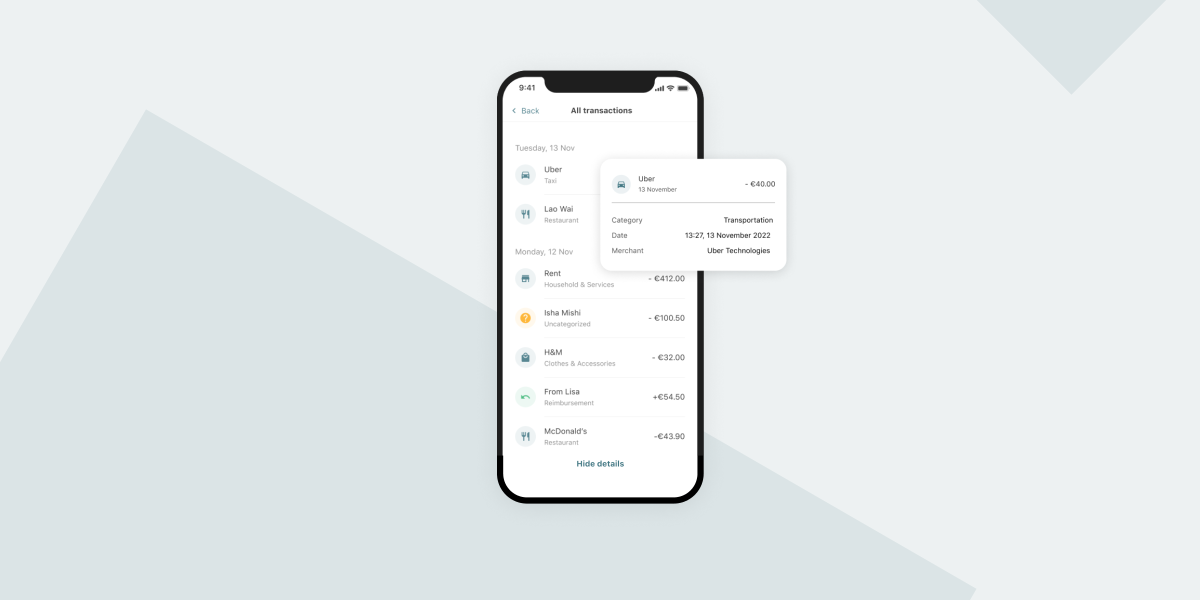

Categorisation: a combination of machine-learning models that identify a category for each transaction. Specific preferences are learned and applied to allow for a personalised experience that fits the user.

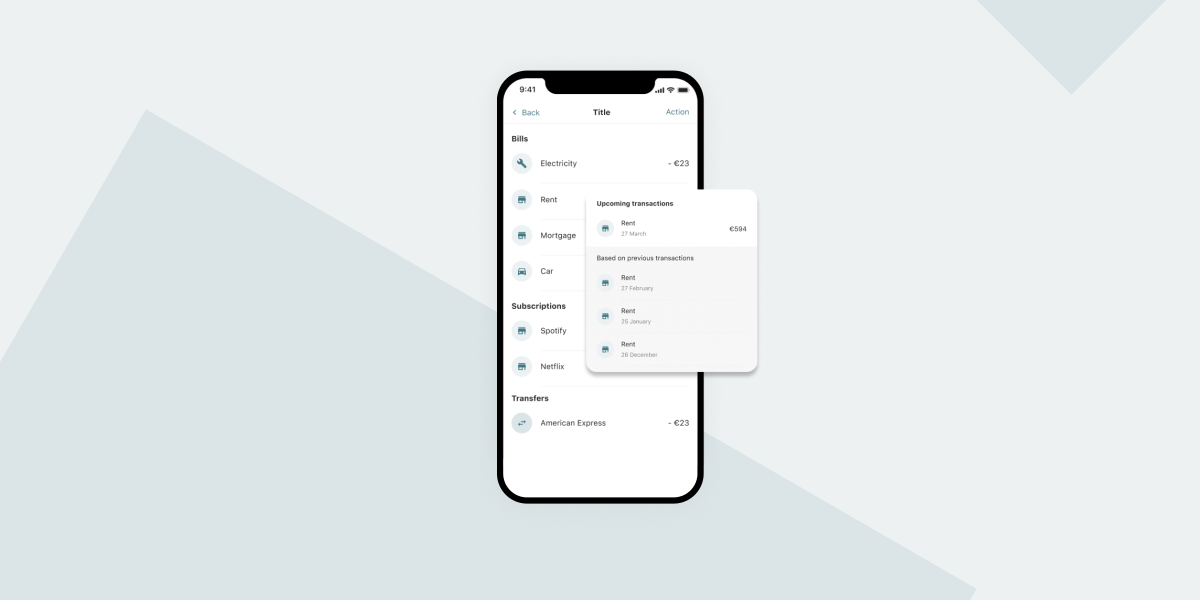

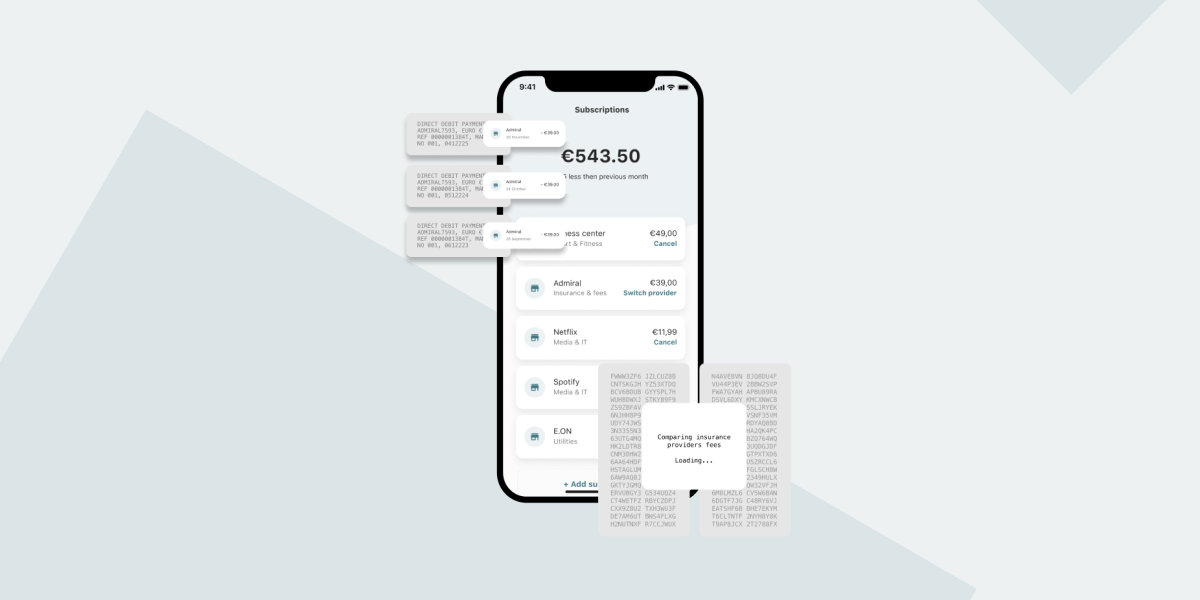

Recurring transactions: historical customer data and behaviours are analysed to find patterns and identify recurring past transactions.

Predicted recurring transactions: a customer's upcoming transactions are predicted by identifying patterns and spending behaviours. This includes all recurring transactions such as subscriptions, gym memberships, loans and utility bills.

Plug in with ecosystem partners: easily plug in with our ecosystem partners to deliver innovative and engaging features beyond finance.

Data enrichment is powered by a set of capabilities.

As well as helping banks accelerate innovation and avoid lengthy in-house development, Data Enrichment capabilities offer invaluable features that enable increased digital engagement.

Examples of use cases and features it helps power include providing customers with a complete financial overview of their categorised transactions, from multiple bank accounts.

Additionally, Data Enrichment helps your customers keep track of fixed costs and contracts such as subscriptions, while highlighting upcoming costs for the next 30 days to prevent overspending.

There’s also a host of possibilities to enable features beyond finance, such as allowing customers to track their CO2 emissions per transaction. This is done by plugging in with one of our ecosystem partners, which is another way to increase the quantity of interactions in your app – giving customers even more reasons to come back.

Data Enrichment can process open banking data as well as transaction data ingested from your bank. When the transaction data has been processed through Tink’s Data Enrichment engine, it can be used for digital banking experiences powered by Tink financial coaching features, in combination with our Money Manager product, or your own financial management solution and frontend.

Interested in learning more about our new Data Enrichment product and how it can help power your digital banking services? Get in touch.

More in Product

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

2024-09-18

14 min read

Connecting the dots: how UX optimisations are driving success rates

We’ve previously explored small tweaks that get big results in open banking conversion rates. This deep dive drills further into how to reduce friction – and improve success rates through a fresh round of incremental changes in our UX.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.