2024-10-14

4 min read

How Northmill’s loan book performance is reaching new heights with Tink

As consumers choose lenders and financial services for hyper-personalised, intuitive and convenient UX, Northmill partners with Tink for an optimal customer experience – and boosts its loan book performance to boot.

Read more

2024-10-08

6 min read

Lending essentials: how enriched data solutions help lenders tackle constraints

Enhancing your affordability assessment with Tink’s data-enriched solutions helps you put an end to inaccurate data, prevent fraud in loan origination and stay compliant – read on to explore the benefits.

Read more

2024-07-24

3 min read

Tink supports DKB with optimising construction loan processes

Top 20 German bank, Deutsche Kreditbank AG (DKB), teams up with Tink to give construction loan seekers a digital, frictionless application process, based on real-time data.

Read more

2024-06-19

7 min read

Borrowers and the cost of living: setting the scene for responsible lending in Sweden

Prioritise investing in data-driven lending models with Tink to make more informed credit decisions, enabling credit access to those who can afford it, while protecting struggling borrowers from getting into financial distress.

Read more

2024-05-28

12 min read

Risk decisioning essentials: our latest categorisation model updates to help you get ahead

Confident decisions, top quality reports and going to market faster are just some of the benefits Tink’s new categorisation model has for lenders – deep dive into the world of generative AI, multilingual models, and more with this guide.

Read more

2024-05-09

5 min read

David van Damme – unlocking the potential of digital lending in Central Europe

Our new Banking & Lending director for the Netherlands and DACH region, David van Damme, shares his insights on these innovative markets, why they’re different and how digitalisation is changing the lending landscape.

Read more

2024-03-05

5 min read

Serving younger borrowers: the impact of inaccessible lending

Streamline risk decisioning as a lender to lower operating costs using data-driven, digital loan origination, affordability assessment and income verification.

Read more

2024-01-16

4 min read

Level up your lending – and meet the challenges of fraud

Prevent fraud in loan applications with data enrichment tools from Tink – while enhancing your affordability assessment, building better UX and future proofing consumer loans for the digital age.

Read more

2024-01-02

8 min read

2024 – what’s on the horizon for payments and data-driven financial services?

From Pay by Bank and VRP, to risk assessments, sustainability and money management tools, 2024 looks set to be the year when data-driven financial services hit the mainstream.

Read more

2023-12-20

1 min read

Lending, levelled up

Tink's new lending white paper – with fresh research from the UK, France, and Germany – details how to elevate affordability assessments with enriched data, and why it’s more important than ever.

Read more

2023-10-25

7 min read

A closer look at UK lending in the cost-of-living crisis

New research shows that one-in-four UK borrowers are using credit to cover essential spending, while 16% take out a loan to make ends meet. For lenders, there is increasing worry around fraud and a desire to improve risk decisioning models.

Read more

2023-09-21

3 min read

Meet Christophe Joyau, Tink’s Senior Vice President of Banking & Lending

Christophe Joyau has played a crucial role in our transition from serving individual customers to business customers and building a B2B SaaS function – he told us about it and what it’s like working with Visa.

Read more

2023-09-05

12 min read

How to reduce fraud in loan applications with enhanced risk decisioning

Beat the challenge of fraud in lending with actionable tools, from risk decisioning to authentication solutions with Tink – while getting closer to inclusive loan origination.

Read more

2023-07-05

2 min read

Make smarter risk decisions with our comprehensive new tool

We have introduced a new feature on the Tink Console called Risk Decisioning, which provides a consolidated risk experience to enhance affordability and risk assessments.

Read more

2023-05-09

5 min read

Deep dive into spending with Expense Check categorisation

Improve affordability assessment and loan applicant experiences with Tink Expense Check, using real-time data and smart expense categorisation to improve affordability assessment.

Read more

2023-04-26

3 min read

Younited partners with Tink to enable instant lending solutions

Younited and Tink have partnered to streamline credit decisions using open banking. Younited’s data-driven approach to loan origination provides fast, accurate and inclusive lending, simplifying affordability assessments for a smoother experience.

Read more

2023-03-21

2 min read

ConTe.it Prestiti partners with Tink for seamless loan origination

Tink and ConTe.it Prestiti team up to power an instant lending application process with open banking, using the Tink Income Check product.

Read more

2023-03-13

4 min read

Multitude Bank partners with Tink for responsible lending processes

Discover how Tink's partnership with Multitude Bank is transforming digital banking across Europe. Streamlining loan origination, improving credit assessments, and promoting responsible lending across 19 countries worldwide.

Read more

2023-03-01

5 min read

Under the hood of Early Redirect – turbocharging income verification

How does Income Check make it possible for lenders to verify income in seconds? We went behind the scenes of the Tink tech team to find out how Early Redirect is powering the open banking lending engine. Marcus Elwin, Associate Product Manager, has the details.

Read more

2023-02-23

5 min read

The lenders’ guide to getting started with open banking

Risk decisioning and creditworthiness assessment technology are the tools lenders need to take loan origination into the future. Learn how Tink can help with this guide to optimising affordability assessment.

Read more

2022-12-16

6 min read

The challenges in underwriting and how open banking can help

Digital loan origination processes powered by open banking are often faster, safer and provide a better customer experience than traditional methods – here’s why.

Read more

2022-12-15

4 min read

Why open banking is important for consumers to manage their finances

Give customers actionable ways to stay on top of their finances with Tink’s open banking tools. From personal finance management to inclusive loan origination, make banking and lending processes work for everyone.

Read more

2022-12-06

3 min read

Closing the data gap for affordability assessment

Quality affordability assessment and creditworthiness are key to the future of lending. Learn how Tink’s open banking platform closes the data gap for lenders and encourages responsible lending.

Read more

2022-11-04

2 min read

How open banking is reducing risk and powering more inclusive lending

Lenders can approve more loans while taking less risk with the help of open banking. Learn more about risk decisioning in our ultimate solutions guide.

Read more

2022-10-31

7 min read

Consumer lending in times of uncertainty

Discover what lies ahead for lending in these uncertain times – and how you can adapt to today’s needs.

Read more

2022-10-26

3 min read

Sambla partners with Tink for a more inclusive lending process

Tink and Sambla partner up to offer better, more inclusive affordability analysis for all types of loan applicants.

Read more

2022-10-13

4 min read

Instantly verify income with Income Check – now with new features

To help businesses make informed and accurate decisions when assessing applications, we’ve made it even easier for them to instantly verify an applicant’s income with the use of granular, up-to-date data. All with just a few simple clicks.

Read more

2022-09-15

4 min read

Under the hood: building a new Tink product

We look under the hood to find out how the Tink tech team tackles the challenges of building our latest lending product, Expense Check – a feature that allows you to assess affordability with facts rather than assumptions.

Read more

2022-09-07

2 min read

Affordability solutions that are leading the way in lending

Affordability and lending. Discover how open banking can help you get a more accurate picture of a potential borrower’s creditworthiness in our ultimate solutions guide.

Read more

2022-08-31

5 min read

Improved affordability assessments with Expense Check

Tink’s new product Expense Check enables lenders to accurately assess applicant’s affordability with open banking. With real-time, granulated expense data, lenders can check the applicant’s creditworthiness in a matter of minutes.

Read more

2022-08-16

2 min read

The solutions that will lead to a new world of finance

Discover the open banking solutions that are leading to a new world of finance.

Read more

2022-07-21

5 min read

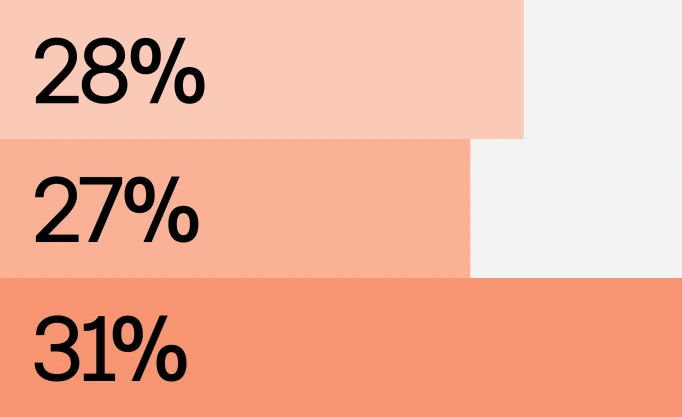

28% of self-employed struggle to access financial services

Self-employed workers are being left out of financial services. Here’s how open banking can help.

Read more

2022-06-02

6 min read

The regulatory requirements in store for lenders – and how open banking can help

In the wake of the pandemic and the digital transformation of finance, consumers are borrowing money they can’t afford to pay back. But open banking holds the key to safely assess applicants’ creditworthiness.

Read more

2022-05-17

6 min read

Build vs buy – a lender’s guide to the pros of partnership

In today’s digital world, it’s all about data – and the seamless user experiences it can power. Learn about the importance of real-time data, optimal UX, and more in this guide to building vs buying.

Read more

2022-05-11

4 min read

Get to know the tech behind better risk assessments

Open banking can help make better informed risk decisions – but access to data is just a part of the puzzle. Find out why quality account aggregation and data enrichment are the foundations of a standout risk assessment process.

Read more

2022-04-28

4 min read

How open banking risk assessments can impact consumers’ lives

It’s no secret that traditional credit checks don’t always work for everyone – but open banking can boost financial inclusion, giving more people access to credit, and fairer results thanks to better risk assessments. Here’s how.

Read more

2022-04-20

4 min read

A simple way to improve risk decisioning

Having a more holistic picture of someone’s financial situation can make all the difference when it comes to making well-grounded risk decisions. Luckily, open banking makes it a lot easier to build strong risk profiles. Here’s how.

Read more

2022-03-24

17 min read

Lender's guide to improving risk assessments with open banking

We dive into the world of risk assessments, exploring challenges lenders face with current decisioning methods, and how the process can become more convenient, reliable and complete thanks to open banking and the smart use of data.

Read more

2021-11-22

6 min read

Improve risk assessment and application processes with data-driven Risk Insights

Creating detailed risk profiles can be hard. But we have a new product to solve that. Find out how Tink’s Risk Insights is giving lenders more information to go on – while also improving the application process for consumers.

Read more

2021-09-30

8 min read

Inside Tink: getting top model performance for Income Check

How do you improve a classification model to sort out what’s an income and what isn’t? Tinker Ida Janér reveals how data scientists in the Risk team embraced confusion and took in regional differences to optimise performance.

Read more

2021-07-07

4 min read

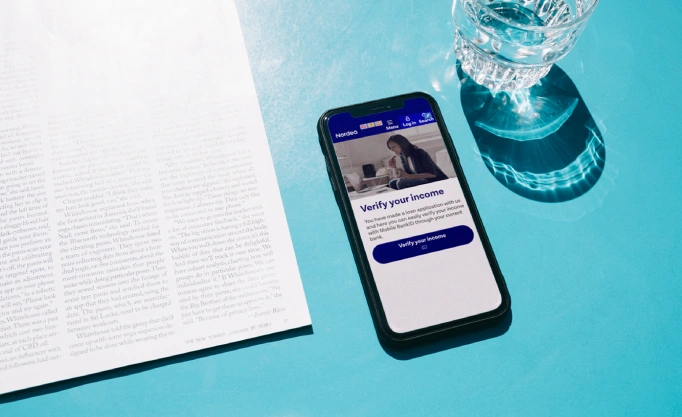

How open banking simplifies income verification

Income verification used to mean having to dig up bank statements, share income tax statements or payslips – and then wait days or even weeks to have it all verified. Now, thanks to open banking it can take seconds. Here’s how.

Read more

2021-06-01

6 min read

3 ways lenders can take advantage of open banking

Find out how the lending industry can benefit from open banking, and how they can leverage new tech capabilities to improve the user experience, reduce costs, increase operational efficiency and optimise results.

Read more