Enabling smoother direct debits with balance check

Today we’re introducing balance check, a key new feature enabling Tink customers to verify their users’ account balances in real-time with data straight from their bank account.

Tink launches balance check – a new feature that enables real-time balance verification to prevent fraud and failed direct debits.

By improving the direct debit collection rate, balance check means fewer unnecessary fees and an increase in operational efficiency.

Balance check is great news for many industries, including online lenders, BNPL services, telco and utility companies, PSPs and more.

Balance check is a new Account Check feature designed to improve the direct debit experience, helping to prevent fraud prior to a direct debit being set up and minimising missed or failed payments throughout the collection cycle. It works by returning real-time balance data when a user connects their account – all part of the same Account Check flow – and lets you refresh the data to retrieve the current balance on an ongoing basis with zero additional user interaction.

Here’s what it means for our customers:

Reduced fraud: verify that a user has sufficient funds pre-purchase, blocking high-risk transactions, or use balance data to power your risk decisioning

Increased collection rate: notify users in advance when a direct debit payment is likely to fail and/or adjust your billing schedule

Lower costs: fewer failed direct debit payments means fewer chargebacks and bounce-back fees, plus less back-office work to chase late payments

Better customer experience: help users avoid unnecessary late payment fees and potential risks to their credit score

… and by instantly verifying both account details and balances in the same flow, you can retain a fast and seamless direct debit setup process

Why this matters

Insufficient funds is the number one cause of failed direct debits and, with the cost of living on the rise, there are already signs that this is translating to an increase in missed payments. A recent report in the UK, for example, stated that 35% of utility services surveyed are seeing a surge in late payments.

A missed direct debit payment can be a painful experience for both sides. For businesses it leads to customer churn and lost revenue, but also extra back-office work to chase a missing payment and all the hidden costs that it entails. The customer, meanwhile, may incur penalty fees and see their credit score negatively impacted.

Balance check addresses these pain points directly. Verifying a user’s balance prior to setting up a direct debit mandate lets you manage your risk up-front or suggest an alternative payment method. You can then retrieve the real-time balance later in the direct debit cycle, and adjust your billing schedule or notify the user in advance. The balance data is refreshed in the background, meaning no additional work for the user for as long as their consent lasts (currently 90 days).

Who this should matter to

We think the ability to simultaneously connect a user’s bank account and verify their balance could be a game-changer for businesses in several industries:

Telco and utility services: Businesses that rely heavily on direct debits can avoid unnecessary fees arising from failed payments, optimise their collection schedule, and generate loyalty by notifying customers in advance and suggesting an alternative payment method

Buy-now-pay-later services: Any business that offers deferred payment schedules can use real-time balance data to reduce risk and improve the post-purchase experience

Online lenders: Assessing customer affordability with balance data can help lower risk while letting you optimise loan repayment schedules

PSPs: Payment providers with their own direct debit solution can offer a white-label balance verification tool to help merchants manage risk and increase payment collections

How it works

By enabling continuous access for Account Check, you can ping a user’s account balance multiple times over the consent period (currently set at 90 days).

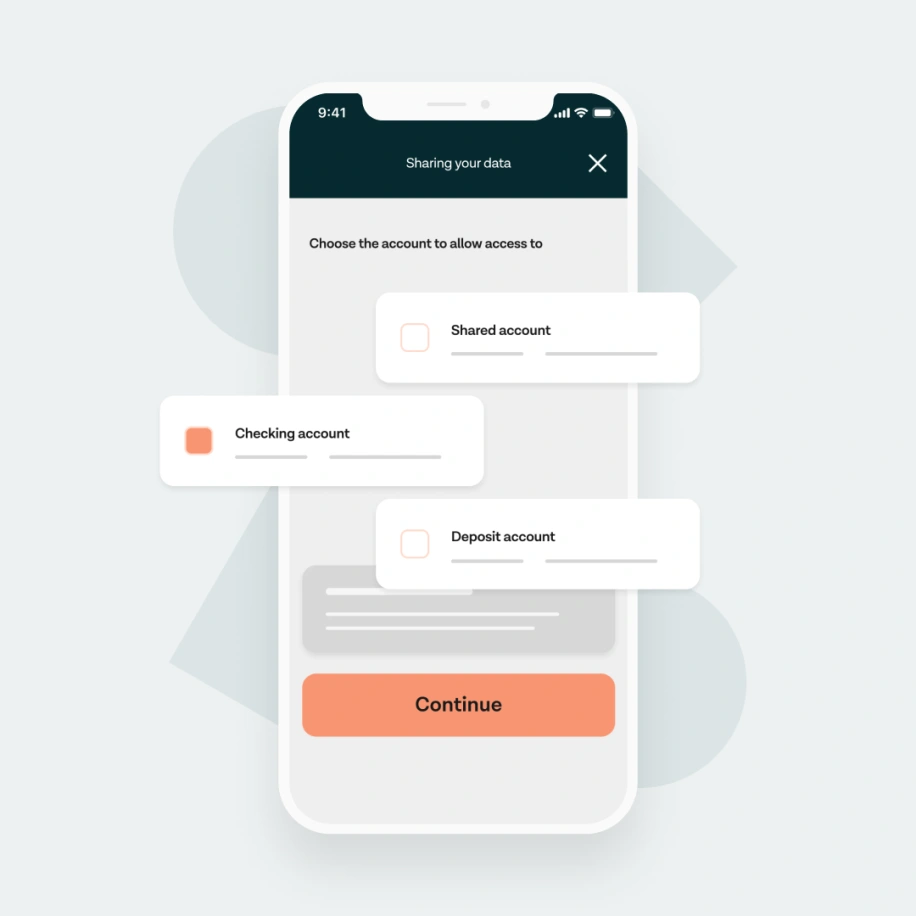

User connects their account: The user authenticates with their bank and gives Tink consent to access their account data. Tink then returns account data and balance data through a new balance endpoint, including the booked and available balance.

Data can be refreshed in the background: Users’ balance data can be refreshed behind the scenes without any user interaction, providing up-to-date information whenever the customer makes an API call to retrieve real-time balance data during the 90-day consent period.

Update consent: When the 90-day consent period ends, the customer can prompt the user to renew their consent with their bank.

Curious about how real-time balance verification could help your business? Try out our Account Check demo for yourself or get in touch.

More in Product

2024-07-17

2 min read

Banking on engagement

This Tink white paper introduces new consumer and retail banking executive research from key European markets, setting the scene for banks to take the next step with Personal Finance Management (PFM).

Read more

2024-05-30

5 min read

Meet Variable Spend: our latest feature for intelligent expense tracking

Expense tracking can be detailed as well as intuitive – say hello to Variable Spend, a new feature of Tink Data Enrichment designed to help banks offer their customers more insight.

Read more

2024-05-28

12 min read

Risk decisioning essentials: our latest categorisation model updates to help you get ahead

Confident decisions, top quality reports and going to market faster are just some of the benefits Tink’s new categorisation model has for lenders – deep dive into the world of generative AI, multilingual models, and more with this guide.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.